As the calendar year winds down, traders often find themselves at the threshold of a potential market rally — a phenomenon often associated with the last week of December, known as the Santa Claus rally. This unique market trend unfolds over the last five trading days in December and the initial two trading days in the following January, usually contributing to a rise in stock prices.

What is the Santa Claus rally?

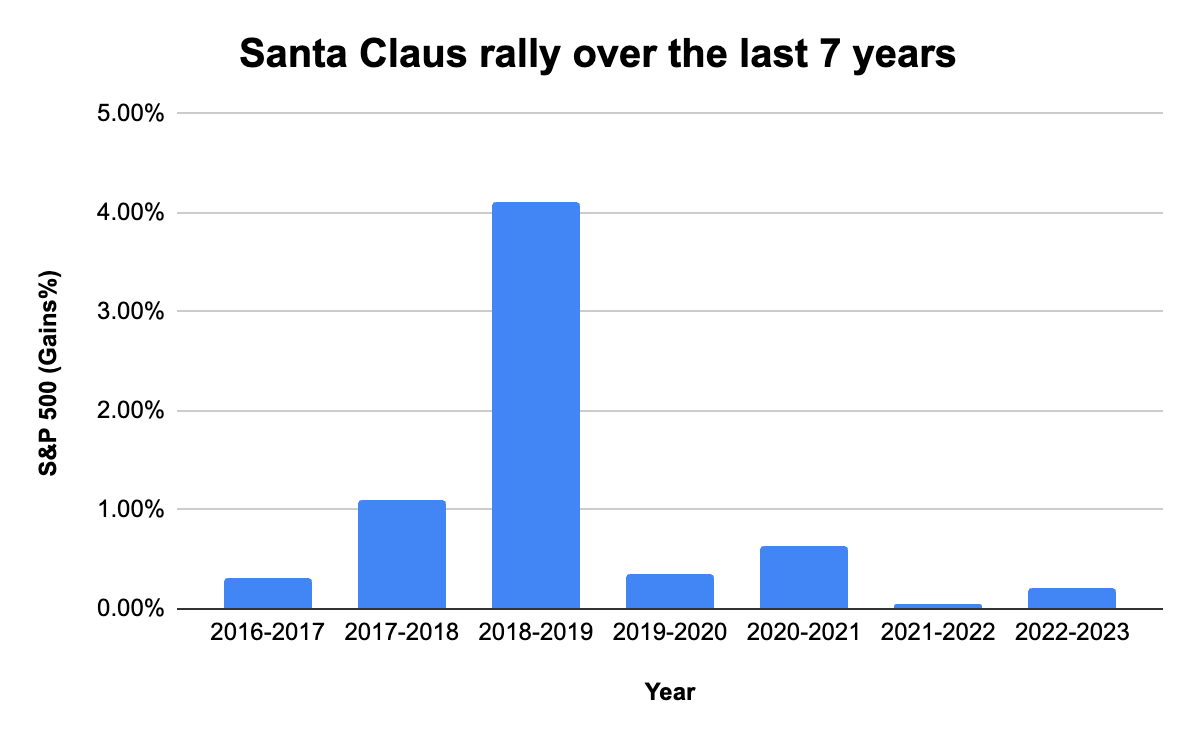

The Santa Claus rally is not merely a seasonal occurrence; it is a dynamic interplay of market forces influenced by various factors. For example, let’s take a look at how the Santa Claus rally affected the S&P 500 over the last few years.

Source: Deriv; info adapted from Yahoo Finance

For the past seven years, Santa has been a consistent visitor to Wall Street, bringing with him the gift of a Santa Claus rally in the S&P 500. This enchanting phenomenon has seen the index notch seven consecutive rallies during the festive season.

As we approach the close of another year, the question looms: will Santa keep his streak alive and deliver an eighth consecutive rally, or are we on the brink of a new market narrative?

What traders can look forward to

Traders frequently witness increased market activity during this period, attributed to heightened purchases in anticipation of the January effect. This anticipation, coupled with lighter trading volume due to holiday vacations, creates an environment where market movements can be more easily influenced, potentially leading to upward trends.

Additionally, the slowdown in tax-loss harvesting at the beginning of December plays a role in this market dynamic. As tax considerations become less pressing, the selling pressure that may have depressed prices earlier in the month eases, contributing to the rally. Furthermore, the tendency for short sellers and pessimistic investors to take vacations around the holidays can further amplify the upward movement.

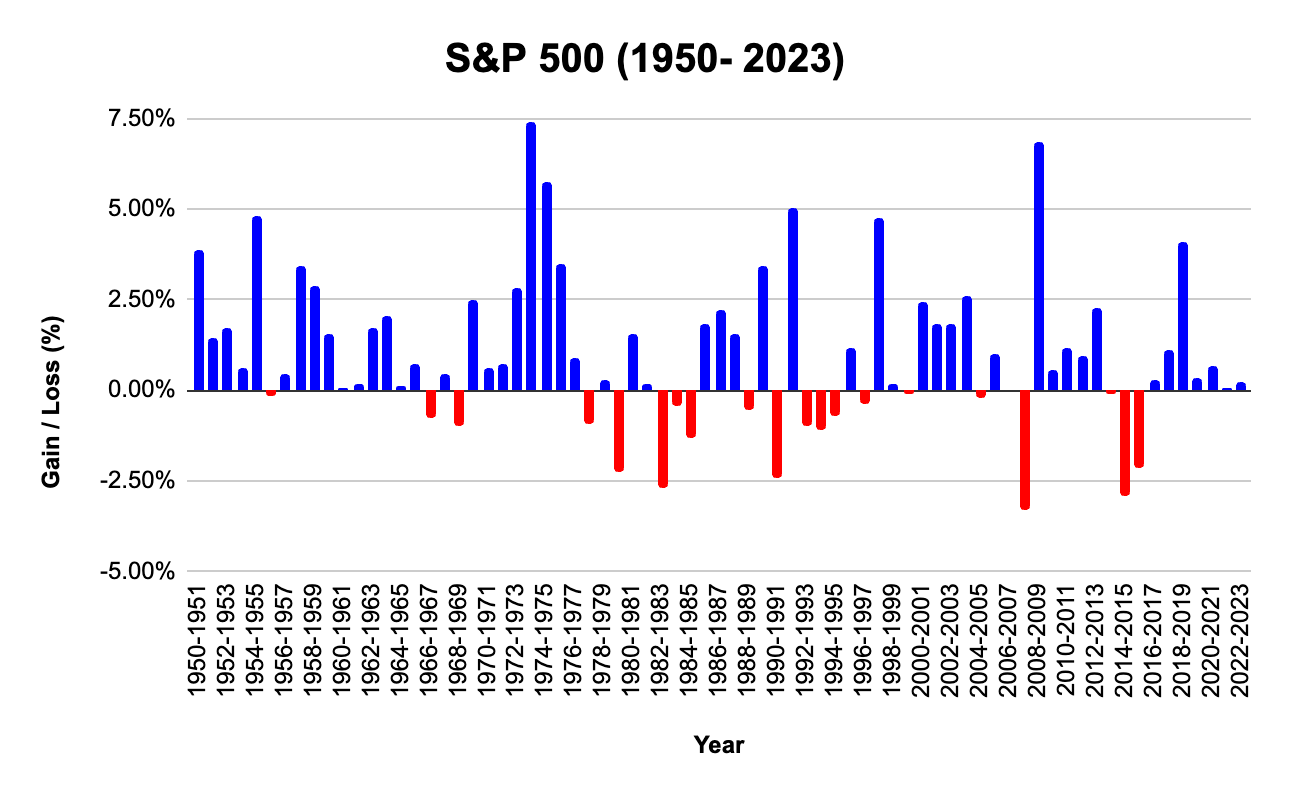

Throughout the identified 7 trading days, stock values have historically experienced an increase about 71% of the time, surpassing the average performance observed during a standard 7-day period.

In this guide, we delve into a comprehensive set of strategic considerations to empower investors in navigating and capitalising on the impending year-end market rally.

From portfolio reviews to market sentiment and from investment strategies to disciplined approaches amid market volatility, this article provides a roadmap for traders seeking to position themselves advantageously as the year concludes, recognising the uncertainties inherent in market fluctuations.

Tips to navigate the year-end rally

Let’s explore the key insights and actionable strategies to ensure a proactive and informed approach to the upcoming market dynamics.

1. Review your portfolio

- Assess your current contracts and identify underperforming assets.

- Consider rebalancing to optimise your portfolio based on market conditions.

- Evaluate the diversification of your trades to ensure a well-balanced and resilient portfolio

- Weed out trades that no longer align with your financial goals.

2. Explore sector rotation strategies

- Analyse historical sector rotation patterns during year-end rallies.

- Adjust your portfolio to align with sectors that are expected to outperform.

- Be flexible in adapting to changing market dynamics and sector trends.

3. Keep an eye on market sentiment

- Monitor market sentiment indicators, such as investor surveys and sentiment indices.

- Be aware of potential market euphoria or panic and adjust your strategies accordingly.

- Consider contrarian approaches if the market appears overly optimistic or pessimistic.

4. Evaluate interest rates

- Keep an eye on interest rate movements as they can influence various asset classes.

- Understand the potential impact of rising or falling interest rates on your portfolio.

- Consider the prevailing interest rate environment and anticipate interest rate expectations for the next year — whether they are expected to rise, remain stable, or fall.

- Adjust your contracts based on a comprehensive understanding of both current interest rate conditions and future expectations.

5. Tax planning

- Evaluate the tax implications of your trade decisions.

- Harvest tax losses to offset gains and minimise tax liabilities.

- Leverage tax-advantaged accounts to optimise your overall tax position.

6. Evaluate liquidity of your trades

- Examine the liquidity of your trades, especially in volatile markets.

- Ensure that you can easily buy or sell assets without significant price impact.

- Be cautious of illiquid trades, and consider divesting if liquidity becomes a concern.

7. Reassess long-term trading strategies

- Reflect on your long-term financial goals.

- Consider whether your portfolio is aligned with your evolving financial objectives and risk tolerance.

- Explore opportunities for long-term growth and adjust your strategy accordingly.

8. Review contract costs

- Evaluate the fees and expenses associated with your contracts to optimise your overall costs.

- Consider low-cost options, such as index funds or exchange-traded funds (ETFs), to enhance potential returns.

9. Monitor technological advancements

- Stay informed about technological developments that may impact industries.

- Consider trades in sectors driven by emerging technologies.

- Be wary of companies that may face obsolescence due to technological shifts.

10. Stay disciplined amid market volatility

- Prepare mentally for market fluctuations and stay disciplined in your approach.

- Avoid making impulsive decisions based on short-term market movements.

- Stick to your long-term plan and objectives.

As the year draws to a close, navigating the potential opportunities and challenges of the year-end market rally requires a strategic and informed approach. This article outlines a comprehensive set of considerations, ranging from portfolio reviews to monitoring market sentiment, sector rotation, and interest rates.

Recognising the uncertainties inherent in market fluctuations, traders are urged to carefully evaluate their holdings and adapt their strategies to align with changing dynamics. As we step into the upcoming market dynamics, the key lies in remaining vigilant, disciplined, and adaptable — a formula for success in the ever-shifting landscape of the financial markets.

Log in to your Deriv account now to check on your positions before the year-end rally.

Disclaimer:

The information contained within this blog article is for educational purposes only and is not intended as financial or investment advice.

Trading is risky. Past performance is not indicative of future results. It is recommended to do your own research prior to making any trading decisions.