The market can stay irrational longer than you can stay solvent.

– John Maynard Keynes

Ever wondered about the ease or difficulty of selling an asset at a fair price?

Take Apple’s stocks, for instance – trading them is as smooth as selling ice cream on a hot day, thanks to their high demand.

On the other hand, selling something like a rare antique coin or the stocks of a smaller company can be more challenging.

That’s illiquidity in action, and it can cost you big time. Let’s find out how to spot illiquidity and avoid its pitfalls.

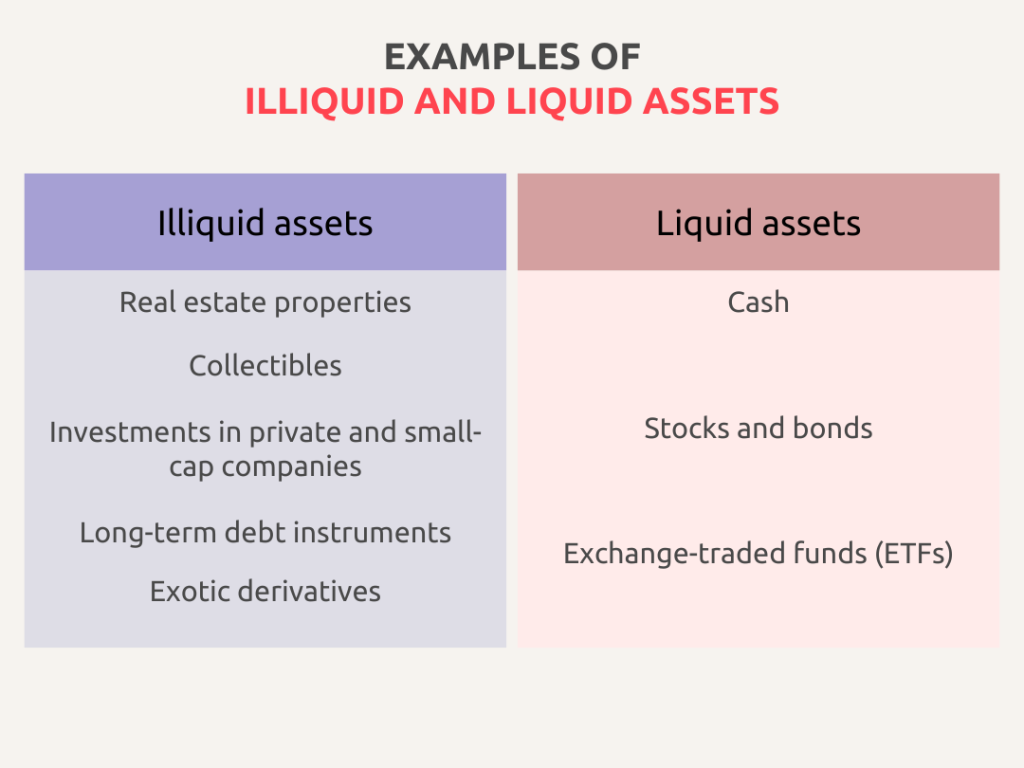

What are illiquid assets? Identify them before you trade

Not all assets are created equal. Here’s how to identify potential liquidity landmines before you invest or trade:

| Low trading volume | Wide bid-ask spread |

|---|---|

| Imagine a stock with only a handful of trades per day. That’s a red flag for low liquidity. Look for assets with consistently high daily trading volume for smoother entry and exit points. | This spread represents the gap between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A wider spread means potentially bigger losses when you sell an illiquid asset. |

The price of illiquidity: What’s the catch?

Illiquidity isn’t just an inconvenience; it can hurt your bottom line:

| ➡️ Discounts and fire sales |

|---|

| If you urgently need to sell an illiquid asset, you might be forced to accept a significant discount to attract a buyer. |

| Missed opportunities ⬅️ |

|---|

| Imagine spotting a golden investment chance, but your cash is tied up in illiquid assets. Illiquidity can leave you on the sidelines when it matters most. |

Liquidity trading hacks: Strategies for savvy traders

Don’t let illiquidity put a damper on your trading goals. Here are some battle-tested strategies to navigate it:

| 🔑 Diversification is key |

| Spread your investments across various asset classes, including some highly liquid options like cash or ETFs. This way, you’ll always have some readily available resources. |

| ⏳ Know your time horizon |

| Are you a short-term trader or a long-term investor? If you need quick access to your cash, prioritise liquid assets. Long-term investors can afford to hold some less liquid assets for potential future gains. |

| 🛑 Limit orders to the rescue |

| A limit order allows you to specify the exact price you’re willing to buy or sell an asset at. This helps you avoid getting stuck with an unfavourable price due to illiquidity. |

Liquidity trading with Deriv

Illiquidity is a fact of life in the trading world, but it doesn’t have to be a showstopper. By understanding the signs and implementing smart strategies, you can navigate these challenges and keep your trading journey smooth sailing. Remember, a healthy balance between liquidity and potential returns is key to unlocking your trading potential.

On Deriv, you can explore a wide range of assets, from highly liquid options like forex and major stock indices to more specialised offerings. Open a free demo account on Deriv and start practising diversification strategies in a risk-free environment. See firsthand how staying liquid empowers you to react to market opportunities and navigate challenges with confidence.

Disclaimer:

Trading is risky. Past performance is not indicative of future results. It is recommended to do your own research prior to making any trading decisions.

The information contained in this blog article is for educational purposes only and is not intended as financial or investment advice.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

We recommend you do your own research before making any trading decisions.