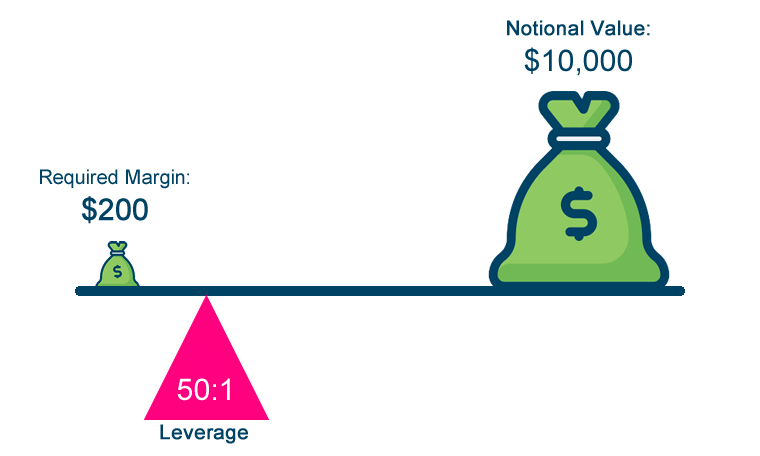

In order to comprehend what currency pair rollovers are, the first step is to understand the essence of CFD forex trading, which involves speculating on the price movements of currency pairs without actually owning the currencies. CFD traders can utilise leverage, which essentially acts as a loan from a forex broker, to control larger positions with a smaller capital investment.

When trading forex pairs, one currency is bought while the other is sold simultaneously. For example, when buying EUR/USD, essentially you’re borrowing (and then selling) US dollars to buy and hold euros in your account.

Thus, CFDs introduce the concept of trading with borrowed funds, which in turn brings interest charges into play.

In this guide, we’ll cover:

- What forex rollovers are

- How to calculate rollover rates

- Trading strategies to optimise rollovers

- MT5 Swap-free accounts

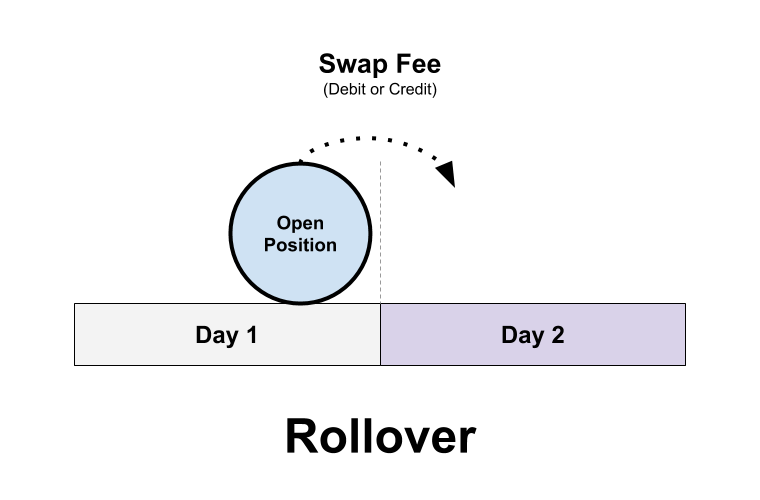

What is a rollover in forex trading?

Rollovers, also known as swap fees or overnight position interest, are costs that traders face when they keep CFD positions open overnight. They are charged in order to compensate the broker for the interest costs incurred while providing the necessary borrowing and leverage to traders.

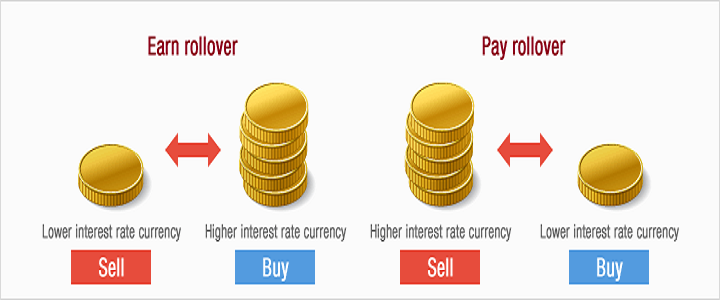

In the forex market, these fees depend on the interest rate differential between the currencies involved in the trading pair. When you purchase a currency with a higher interest rate compared to the one you sell, you receive a credit. Conversely, if the interest rate of the currency you buy is lower than the one you sell, you’ll incur a rollover fee.

How to calculate rollover rates

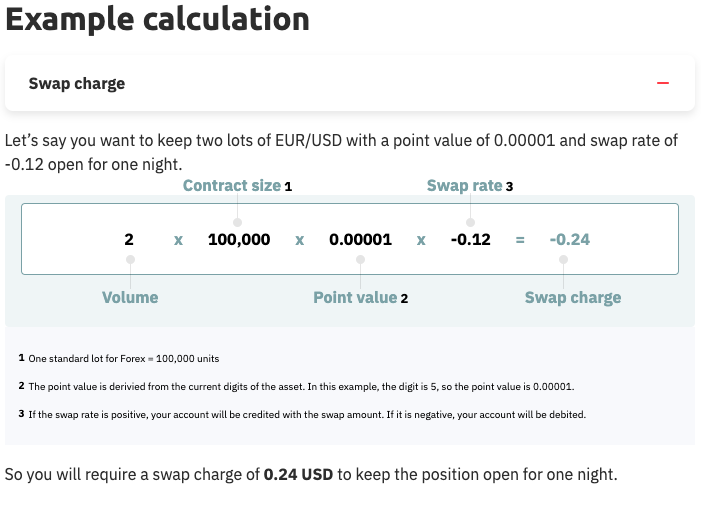

Traders can calculate swap fees using Deriv’s swap calculator, which is computed based on the size of the trade (volume), the contract size (forex is 100,000), the point value/digits of the currency pair (0.00001 or 0.001), and most importantly, the difference in interest rates between the two currencies of the trade (swap rate):

Swap charge = volume × contract size × point value × swap rate

For example, let’s say you want to keep two lots of EUR/USD with a swap rate of -0.12 open for one night.

You will be charged a swap fee of 0.24 USD to keep the position open for one night. It is also important to be aware that on Wednesdays, the swap fee is triple to cover the weekend days when the forex market is closed. So for Wednesday rollovers, using the above example, you may face a charge of 0.72 USD rather than the usual 0.24 USD.

You can check the swap rates of specific forex currency pairs on our trading specification page.

Trading strategies to optimise rollovers

One strategy is to either buy currency pairs with positive interest rate differentials such as USD/JPY or sell pairs with negative interest rate differentials like USD/MXN. This results in earning rollover fees instead of having to pay them. However, because of the attractiveness to earn this “carry”, these positions are usually very crowded and susceptible to volatility and sharp reversals which could stop out positions.

On the other hand, traders who have short positions in pairs with positive interest rate differentials or long trades on pairs with negative interest rate differentials, may want to adopt a short-term, intraday trading strategy and close out their positions in these pairs before the daily rollover, particularly on Wednesdays to avoid being charged the triple swap fee.

MT5 Swap-free account

For traders looking to completely avoid swap and rollover fees, Deriv offers the option to open an MT5 swap-free account. These accounts adhere to Islamic finance principles which prohibit the charging or receiving of interest.

Overall, traders who understand the mechanics of rollovers and interest rate differentials can structure their forex positions to take advantage of earning swap fees or minimising any paid fees. Carefully planning entries, exits, and time around rollovers are key elements of an effective fee-reducing forex trading strategy. While managing rollover costs is essential, it’s also crucial for forex traders to consider other risk management trading strategies.

You can open a demo or live trading account with Deriv here to explore how rollover rates work in forex pairs.

Disclaimer:

*Swap-free accounts are not available to clients residing in the EU.

The information contained in this blog article is for educational purposes only and is not intended as financial or investment advice.

Deriv MT5’s availability may depend on your country of residence.

Trading conditions may vary depending on your country of residence