US Indices

|

Name of the index |

Friday’s close |

Net Change |

Net Change (%) |

|

Dow Jones Industrial (US 30) |

34,899.34 |

-719.91 |

-2.02% |

|

Nasdaq (US Tech 100) |

16,025.58 |

-355.40 |

-2.17% |

|

S&P 500 (US 500) |

4,594.62 |

-88.32 |

-1.89% |

Source: Bloomberg

Stocks ended the week on Friday, 26 Nov 2021, facing its worst day of the year. All 3 major indices dropped sharply in the half-day session as a new Covid variant, recently named Omicron, was discovered in South Africa triggered a global shift away from risk assets.

The World Health Organisation officials announced that further investigations of the new strain are needed. But fears of it showing resistance to current vaccines sent shock waves through the financial markets.

Concurrent market highs at the start of November seem far-off following Friday’s market shift. Bond prices lifted as yields tumbled amidst a flight to safety. The benchmark U.S. Treasury note lost 15 basis points to close at 1.48%. This marked a sharp reversal from the 1.68% level that was hit earlier in the week.

Travel stocks were hit the hardest. Delta Air lines and American Airlines were down 7.08% and 7.12%, respectively, and Boeing Co took a nose-dive to end the week 11.45% lower. Bank shares also pulled back, along with industrials linked to the global economy.

This week’s winners were those whom investors huddled into during the sell-off, namely vaccine makers. Pfizer was up 4.29%, whilst Moderna shares skyrocketed above 20%. Corporations that support stay-at-home workers also benefited, with Zoom and Netflix each gaining more than 5%.

In the coming weeks, all eyes will be on the new vaccine developments. Investors are banking on a quick containment of the new strain for global markets to calm. Jerome Powell, newly re-elected Chair of the Federal Reserve, is also expected to make a statement on future monetary policies this week. As inflationary pressures remain a threat, market watchers will be watching for any reactive changes in monetary policy.

Trade US indices options on DTrader and CFDs on Deriv MT5 Financial and Financial STP accounts.

Forex

|

|

Source: Bloomberg

The data for EUR/USD has been relatively mixed. The Manufacturing Purchasing Managers Index (PMI) in the EU for November was better than expected, signalling an increase in inflation during the month. In the US, the Core Personal Consumption Expenditure (PCE) Price Index was also better than expected on a yearly basis. The minutes from the FOMC meeting show that the Fed members are concerned about the rise in inflation and are willing to tighten the policy sooner if needed, whereas the ECB is in no rush to change its monetary policy as of now.

In addition, the new COVID-19 variant caused a downturn in market sentiments and reignited the COVID-19 fear. This week the EU will bring in updates on the Consumer Price Index, whereas in the US, the main updates would be on the Central Banks Consumer Confidence, Non-Farm Payroll, and ADP Non-Farm Employment Change. EUR/USD ended at the $1.13 mark, and its next support level at the 38.2% retracement level is near $1.123. The resistance for EUR/USD at the 50% retracement level is near $1.14.

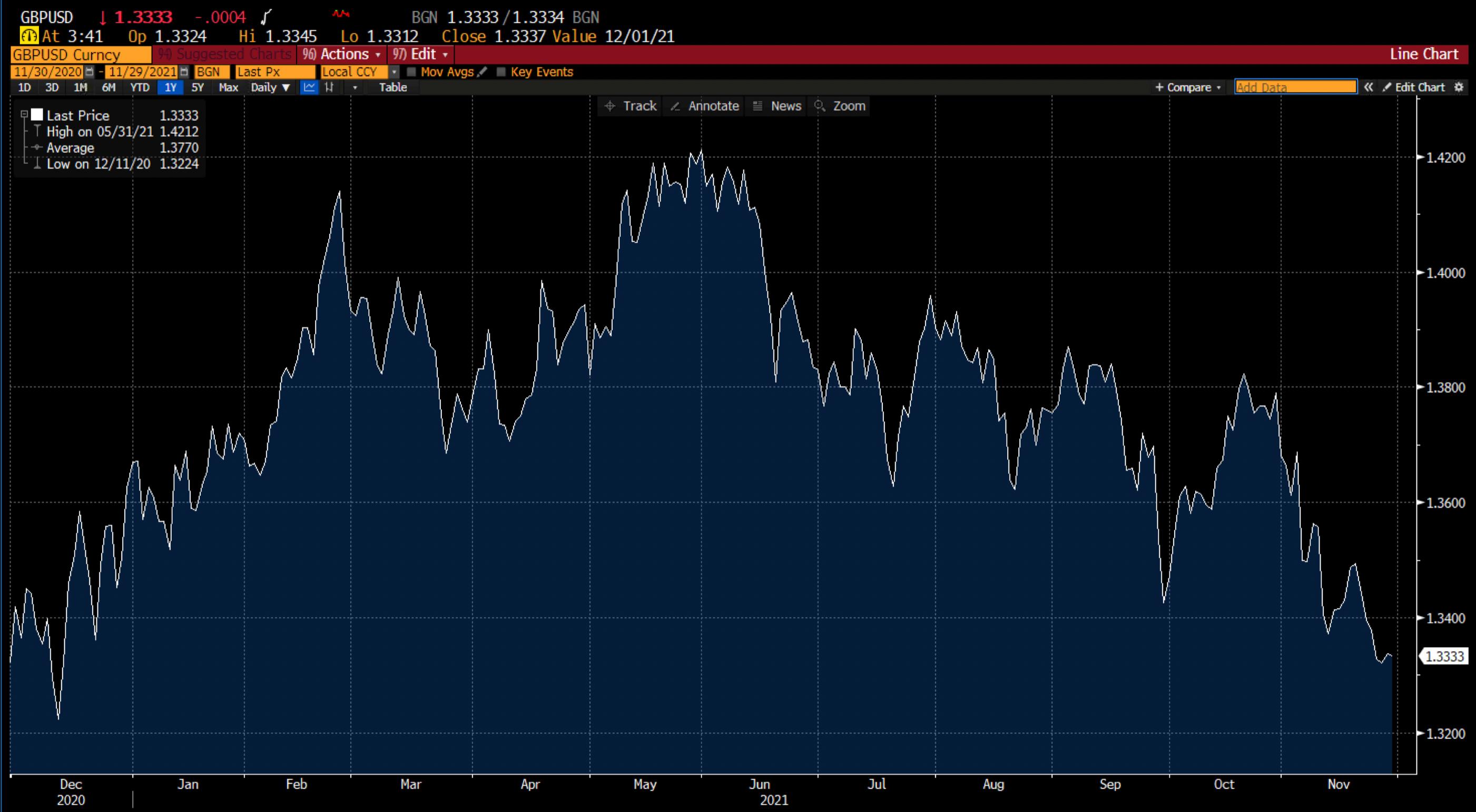

GBP/USD stayed on the lower end last week despite better than forecasted Purchasing Managers Index readings. The Bank of England previously decided to hike the interest rates in December by 15 basis points but this decision may be scaled back after the new coronavirus variant was detected.

The US dollar, on the other hand, was boosted based on the hawkish Fed comments and the renomination of Jerome Powell as the Fed Chairman. This week will feature the Purchasing Managers Index readings for the GBP, ADP Non-Farm Employment Change and Non-Farm Payroll for the USD. The pair ended at $1.33, and its next support level is the 61.8% retracement level near $1.31, followed by a 50% retracement level near $1.28. Resistance is seen at 78.6% retracement levels near $1.37.

The Japanese yen jumped against major currency pairs on Friday, 26 Nov 2021, as investors sought out safe-haven assets after getting spooked by news of a new COVID-19 variant detected that may be able to evade immune responses and counter vaccine effects.

Trade forex options on DTrader and CFDs on Deriv MT5 Financial and Financial STP accounts.

Commodities

Source: Bloomberg

Gold continued to struggle against the U.S. dollar last week. The reason behind the downfall was mainly due to the surge in the Treasury yields. The renomination of Jerome Powell as the Fed chair was also a factor, strengthening the view that the interest rates are going to hike up by June 2022.

The recently detected COVID variant led global equities to suffer heavy losses, and the 10-year Treasury yield to fall below 1.50% at the end of the week leading to XAU/USD finishing near $1,788.85. The support level at the 23.6% retracement level is near $1,772.55. The resistance for XAU/USD at the 38.2% retracement level is near $1,829.00 followed by a 50% retracement level near $1,875.50.

Oil fell by around 13.50% last week due to the fear of coronavirus and its possible effect on the demand for fuel and travel outcomes. China, India, Japan, South Korea, the U.K. and the U.S. are agreeing to release barrels of crude oil to help cool down the price. OPEC is set to meet this week, and these demand concerns could cause them to delay or halt their planned increase in the supply of oil. Oil is currently trading at the $68 mark, just above its support level at the 78.6% retracement level near $66. The next support level at the 61.8% retracement level is near $52, whereas the resistance level at the 127.2% retracement level is near $107.

Trade commodities options on DTrader and CFDs on Deriv MT5 Financial account.

Cryptocurrency

Source: Bloomberg

The new variant of coronavirus is roiling global markets, with its impact not sparing cryptocurrencies. Bitcoin wasn’t exempt from the carnage despite being seen by crypto enthusiasts as a hedge against market turmoil.

The world’s largest cryptocurrency was down more than 20% from an all-time high of nearly $69,000, which hit earlier this month. Ether, the second-largest crypto, fell more than 10%, while XRP slumped by 9.9%.

On the technical side, Bitcoin remains above its major first support level of $53,500 at the 61.8% retracement level. The second support level sits at the $48,700 level at 50% retracement. On the upwards side, resistance is found at $60,300 for a medium-long term outlook.

Market watchers remain divided on whether Bitcoin has lost its steam off the back of recent record highs in early November. Believers in cryptocurrency, however, are not phased by Bitcoin’s bearish momentum. Optimistic Bitcoin bulls claim the dip to be a temporary shock that serves as the perfect opportunity to buy.

Trade cryptocurrency options on DTrader and CFDs on Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading on stock, stock indices, commodities, cryptocurrencies, and forex on DTrader are not available for clients residing within the European Union or the United Kingdom.

CFD trading on cryptocurrencies is not available for clients residing within the United Kingdom.