Financial markets saw volatility, gains, and drops last week as traders’ risk appetites were affected by various factors.

Forex

Source: Bloomberg. Click to see full size

Last week, EUR/USD saw a slight reversal in the long-term downtrend it was on from the beginning of June. At the start of last week, the currency pair saw an upward movement ever since it moved past the $1.0500 mark. Later, the EUR/USD pair saw a decent pullback on Thursday, 23 June 2022. However, this was short-lived as the bulls resumed their upward run, and the pair ended the week above the $1.0600 mark.

This trend change can be attributed to the weakening of the greenback over the past week. Despite the $1.0670 level acting as an upside cap to the pair, it is unlikely that the pair will break out of its slump soon. Furthermore, geopolitical concerns and the Federal Reserve-European Central Bank divergence will keep the upside in check.

Meanwhile, the GBP/USD downtrend flattened out last week, experiencing its first weekly gains of the month. The bulls stepped in to merely stop the falling pair, which mostly traded sideways throughout the week.

Due to the US dollar gaining strength, the cable pair mirrored the EUR/USD’s movement with a sharp dip below $1.2200 on Thursday, 23 June 2022. Compared to the start of the week, the pair saw a marginal increase at Friday’s close. As you can see from the chart, GBP/USD ended the week at $1.2272, bisecting the SMA 5 and SMA 10 at $1.2270 and $1.2274, respectively.

Level up your trading strategy with the latest market news and trade CFDs on your Deriv X Financial account.

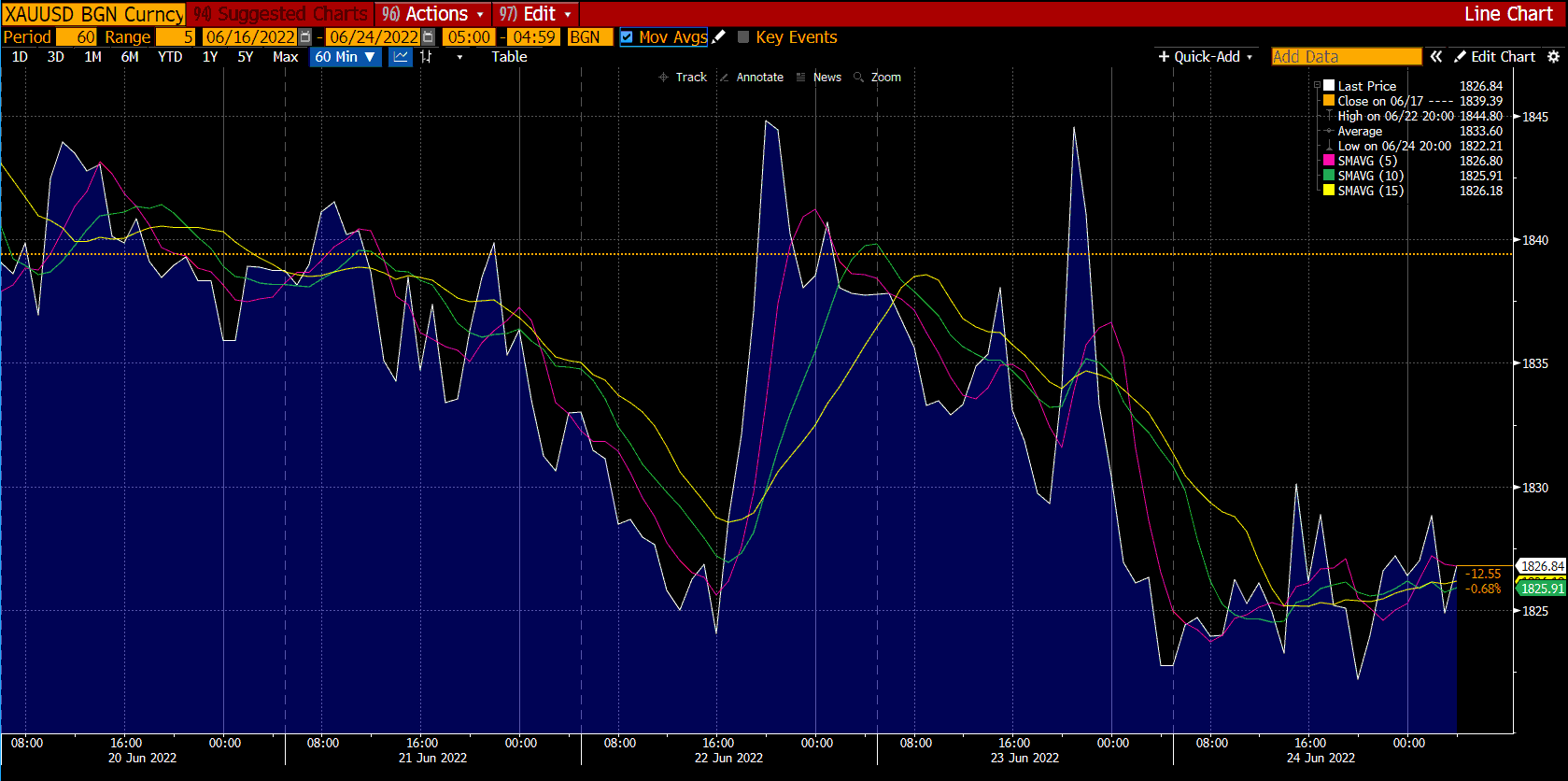

Commodities

Source: Bloomberg. Click to see full size

Gold started the week modestly flat at around $1,840. It then proceeded to find a floor due to the thinner liquidity condition brought on by the US holiday of Juneteenth. However, XAU/USD’s upside remains capped, as traders seem wary of the Fed’s aggressive monetary policy.

On Thursday, 23 June 2022, the yellow metal extended its losing streak into the fourth straight trading day. This drop is linked to the market’s reassessment of Fed Chair Jerome Powell’s testimony in the bi-annual Monetary Policy Report, where he managed to gain acceptance for his justification of the recent rate hike. However, his testimony apparently favoured the risk appetite and gold prices momentarily, resulting in an upward movement. Nevertheless, gold still ended with losses for the second consecutive week.

The second half of June hasn’t been the best for WTI oil as it fell sharply on Wednesday, 22 June 2022. This fall resulted from US President Biden’s push to bring down soaring fuel prices. The move, which includes pressure on major American energy companies to lower fuel prices as they have been reaping huge profits, calls for a temporary suspension of federal taxes on gasoline. However, WTI oil regained traction and rebounded on Friday, 24 June 2022. With OPEC (Organisation of the Petroleum Exporting Countries) member Libya closing nearly all production due to unrest, supply concerns were revived, leading to WTI oil’s recovery.

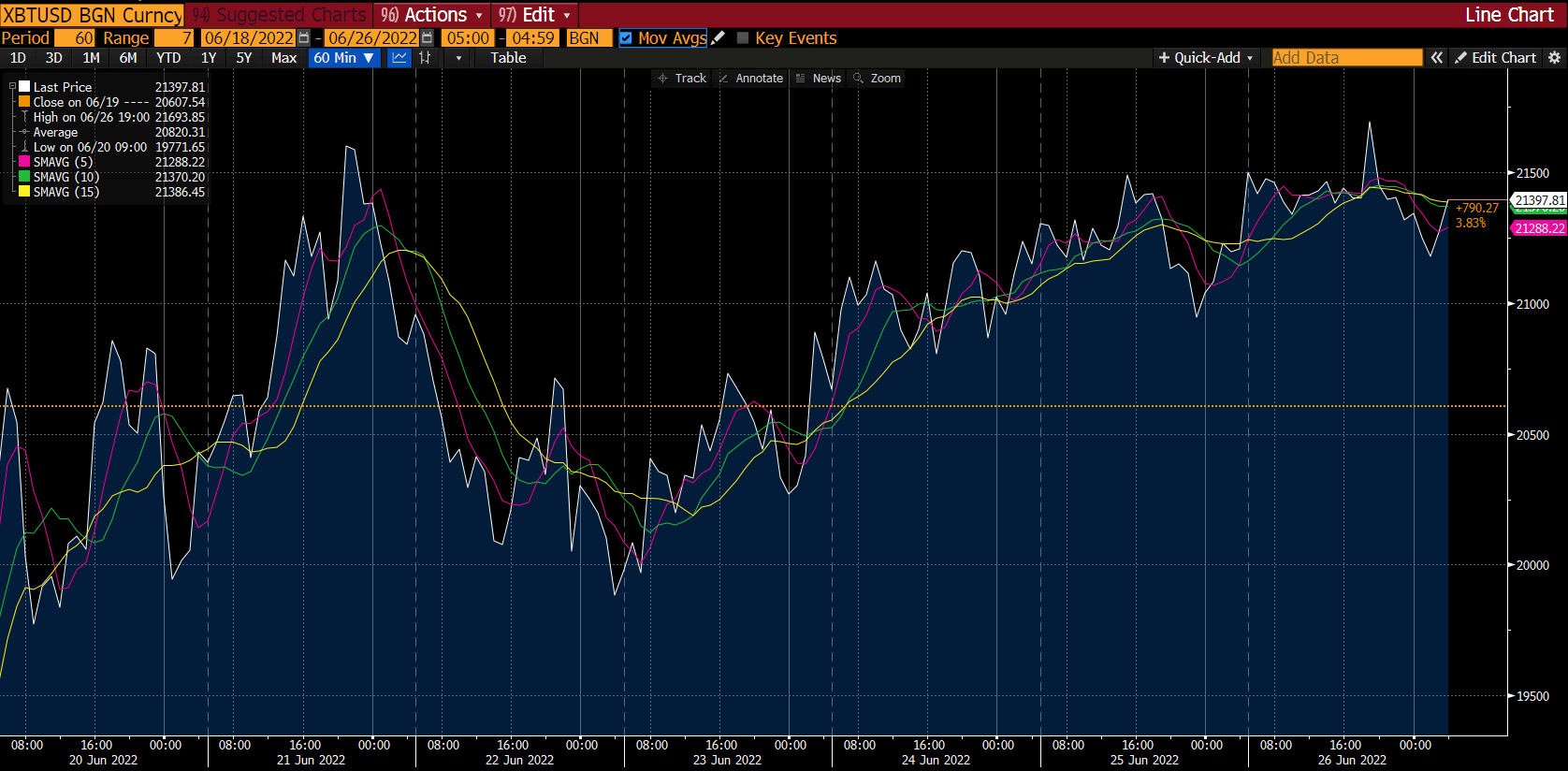

Cryptocurrencies

Source: Bloomberg. Click to see full size

Despite the total market value of all cryptocurrencies rising by $40 billion last week, it remained below the $1,000 billion threshold. Because of this weekly rise, June’s deficit is now $373 billion.

Following its downward drop, the price of Bitcoin stabilised once again over the $20,000 mark. As seen in the chart above, Bitcoin closed the week up by 2.33% at the $21,400 level. Since it ended the week trading at its resistance level, traders are waiting to see if this is the new support level.

Meanwhile, Ethereum, which fell as low as $880 on Saturday, 18 June 2022, increased by 5.8% on Sunday, 26 June 2022, to $1,280.

Recently, the market for digital assets has experienced extreme volatility as traders dumped riskier investments due to concerns that aggressive interest rate increases could lead to an economic downturn. Furthermore, traders reduced their stakes in cryptocurrencies after the price of Bitcoin fell last week to its lowest level since 2020.

In the coming week, significant US economic metrics and central bank discussions might put traders’ appetites to the test. Among these events, G7 summit updates and remarks from Fed Chair Powell, European Central Bank’s President Lagarde, and Bank of England Governor Bailey will be included.

Maximise market opportunities by sharpening your trading strategy and trading the financial markets with options and multipliers on DTrader.

US stocks market

|

Name of the index |

Friday’s close |

*Net change |

*Net change (%) |

|

Dow Jones Industrial Avg (Wall Street 30) |

31,500.68 |

970.43 |

3.18% |

|

Nasdaq (US Tech 100) |

12,105.85 |

559.09 |

4.84% |

|

S&P 500 (US 500) |

3,911.74 |

146.95 |

3.90% |

Source: Bloomberg

*Net change and net change (%) are based on the weekly closing price change from Monday to Friday.

As markets head towards the end of June, stocks completed a big comeback week. The S&P 500, the Nasdaq Composite, and The Dow closed over 3% higher than the previous week.

The stock market started picking up on Wednesday, 22 June 2022, as traders slightly stopped worrying about a recession. Despite last week’s Federal Reserve announcement of a 0.75% rate hike – the most significant since 1994 – Fed Chairman Jerome Powell told Congress the Fed is “firmly committed” to bringing inflation down.

Moreover, last week’s economic data indicated that the Federal Reserve’s aggressive move toward monetary tightening was having the desired effect of slowing the economy and moderating inflation.

All 11 of the benchmark index’s sectors rallied. Among them, FedEx was nearly up by 7.2%, eBay jumped by 6.3%, and Goldman Sachs Group’s stock price surged by 5.8%.

The Federal Reserve also said that US banks could comfortably withstand a severe economic downturn based on their capital and assets. Based on comments from Powell, interest rates are expected to go up by another 0.50% or 0.75% at the next Fed meeting in July. So, traders are watching closely and look forward to Powell’s speech scheduled for later this week.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading, Deriv X platform, and STP Financial accounts on the MT5 platform are not available for clients residing in the EU.