Cryptocurrencies experienced one of their worst weeks in history thanks to the Fed’s announcement to raise interest rates. However, other markets also experienced setbacks due to this announcement.

Forex

Source: Bloomberg. Click to see full size

Although the core inflation result for May 2022 came in as expected and strengthened the Euro, the currency does not seem to be reversing its long-term plunge. This further intensifies the inflationary pressure on the European Central Bank (ECB) as it battles the concern of a fading Euro. On the other hand, the continued strengthening of the US dollar has caused the EUR/USD pair to close the week in the negative territory.

As seen in the chart above, after starting the week on a downtrend and falling to $1.1971, the GBP/USD pair experienced a short-term rally on Thursday, 16 June 2022, and prices reached a three-day high of around $1.2381. Furthermore, the release of disappointing US macro data weakened the greenback and served as support to the declining GBP/USD pair.

Moreover, its slight recovery from two-year lows faltered due to the diverging monetary policy announcements by the Fed and Bank of England (BoE) towards the end of last week. As a result, the currency pair ended the week at $1.2227, slightly above the SMA 10 at $1.2220 and nearly bisecting at its SMA 5 and SMA 15 at $1.2211 and $1.2245, respectively. Now, all eyes are on the UK inflation report and the Fed Chairman’s testimony for fresh directional commands for the cable pair.

The Bank of Japan (BoJ) governor announced that the monetary policy could be eased further if needed. This triggered a JPY sell-off, which, combined with the US dollar rebound, explains the USD/JPY bullish run.

Level up your trading strategy with the latest market news and trade CFDs on your Deriv X Financial account.

Commodities

Source: Bloomberg. Click to see full size

After starting the week above $1,870, gold prices plummeted below $1,810 on Tuesday, 14 June 2022, for the first time since traders began withdrawing from the market in February.

Gold is often regarded as an inflation hedge, but the opportunity cost of holding it is higher when the Fed raises short-term interest rates since the metal yields no interest.

Despite closing the week at $1,840 on Friday, 17 June 2022, gold closed at its lowest level in almost a month as a stronger US dollar and interest rate hikes from the Federal Reserve, Swiss National Bank, and Bank of England dented the safe-haven metal’s appeal.

As seen in the chart above, gold ended the week trading right above its support level of $1,837. The outlook for interest rate policies and inflation expectations shifts in the coming week will significantly impact the yellow metal.

Meanwhile, oil prices suddenly reversed from the long-term uptrend after climbing up to almost $125 a barrel earlier this month. On Friday, 17 June 2022, oil prices fell by 6% to a four-week low and ended the week at around $112 a barrel. This occurred due to the interest rate hike by major central banks that would slow down the global economy and limit energy demand.

Cryptocurrencies

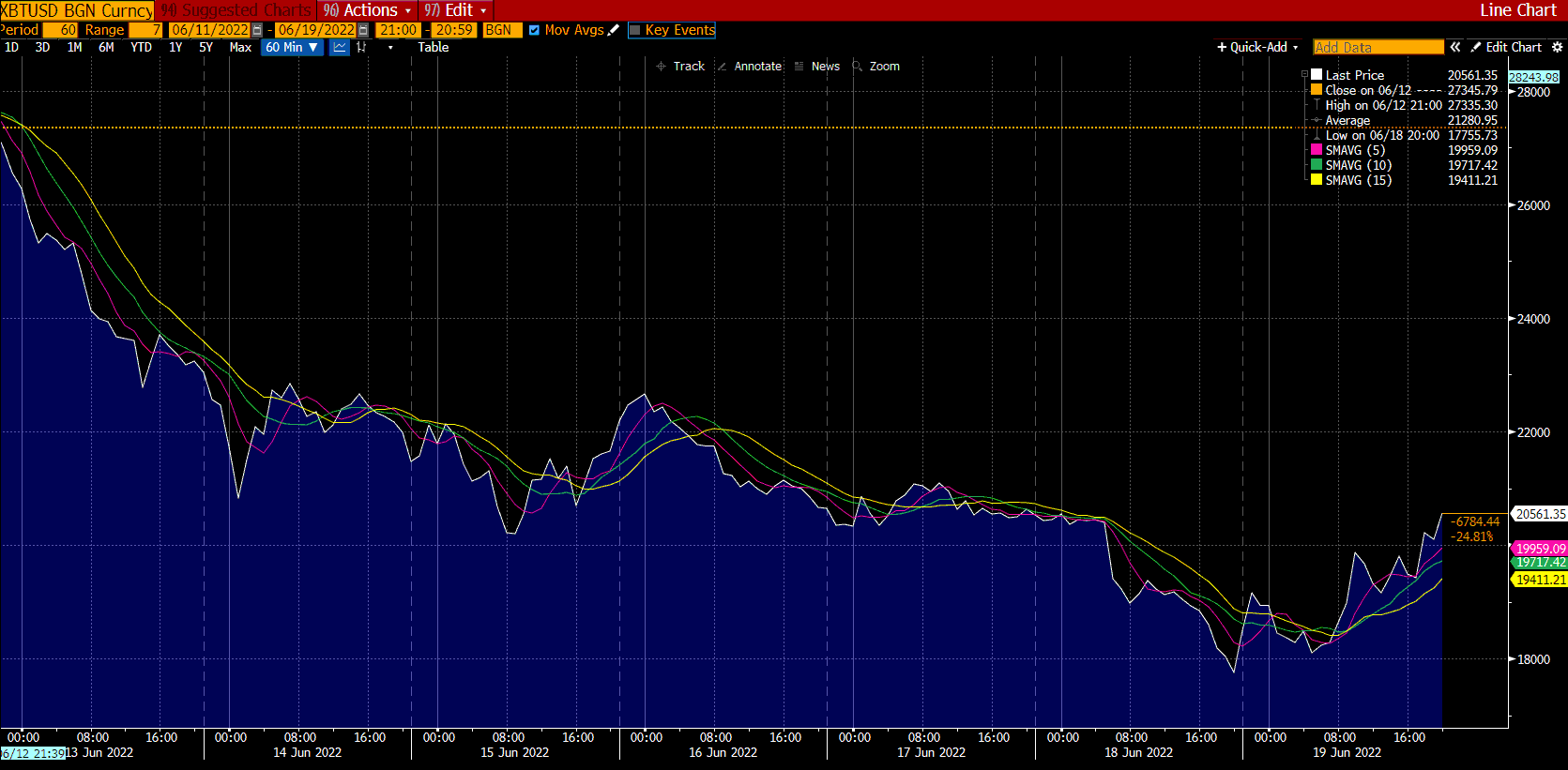

Source: Bloomberg. Click to see full size

The crypto market fell below $1 trillion for the first time since January 2021. With a loss of $300 billion in seven days, last week was one of the worst weeks in crypto history.

In the chart above, the price of Bitcoin continued to slump, dropping by 34% in the past 7 days and trading below the $20k mark. However, Bitcoin has clawed its way back to around the $20k mark on Sunday, 19 June 2022. This movement may indicate a swift turnaround after the recent successive declines since institutional traders may see a buying opportunity after Bitcoin reaches the rock-bottom level.

Meanwhile, Ethereum, in particular, performed poorly, going down by 40% over the same period and trading at around $1,000.

In part, macroeconomic factors were to blame for the downfall of the crypto market. Recently, cryptocurrencies have not been working as an inflation-proof asset as the performance of equity and bond markets has directly impacted Bitcoin. Inflation has been rising lately, causing central banks to raise interest rates, hitting risky assets.

Due to the extreme market conditions, several cryptocurrency-lending companies have halted their operations in withdrawals, transfers, and swaps requests. This has indirectly led to a sell-off from crypto traders as this raises concerns about the future of cryptocurrencies.

Maximise market opportunities by sharpening your trading strategy and trading the financial markets with options and multipliers on DTrader.

US stocks market

|

Name of the index |

Friday’s close |

*Net change |

*Net change (%) |

|

Dow Jones Industrial Avg (Wall Street 30) |

29,888.78 |

-627.96 |

-2.06% |

|

Nasdaq (US Tech 100) |

11,265.99 |

-22.33 |

-0.20% |

|

S&P 500 (US 500) |

3,674.84 |

-74.79 |

-1.99% |

Source: Bloomberg

*Net change and net change (%) are based on the weekly closing price change from Monday to Friday.

All 3 major indices finished the week with sharp losses. This was the most significant decline for the S&P 500 since the pandemic hit markets in March 2020. Furthermore, the Dow faced its biggest drop for the week since October 2020. The market has now lost ten times in the last 11 weeks overall.

Since every company in the index was in the red at least once during the week, the S&P 500 is officially in a bear market.

On Wednesday, 15 June 2022, the Federal Reserve announced a 0.75% interest rate increase — the largest since 1994. Stocks were on the rise, however; after the announcement, the Dow dropped to levels not seen since January 2021. Furthermore, all 11 stock market sectors saw declines.

Amid growing recession fears, Home Depot, Intel, and JPMorgan hit new 52-week lows. Meanwhile, tech giants like Amazon, Apple, and Netflix sank by nearly 4%.

The Fed’s comments on Friday, 17 June 2022, echoed their commitment to clamping down inflation after hiking rates by 75 basis points earlier in the week. Now, traders are looking forward to Powell’s testimony later this week as the Fed appears to remain focused on returning inflation to its 2% target.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading, Deriv X platform, and STP Financial accounts on the MT5 platform are not available for clients residing in the EU.