Forex

Source: Bloomberg. Click to see full size

The EUR/USD pair plummeted for the second week in a row, hitting a new two-year low of $1.0758 before settling a few points over $1.0800. The key bearish catalyst was that the European Central Bank announced President Christine Lagarde would make no adjustments to their monetary policy. On the other hand, US Federal Reserve officials continue to expect a 50 bps hike in May 2022, paving the way for a balance-sheet reduction. As a result, the imbalance between the two central banks will almost certainly continue to weigh on the EUR/USD.

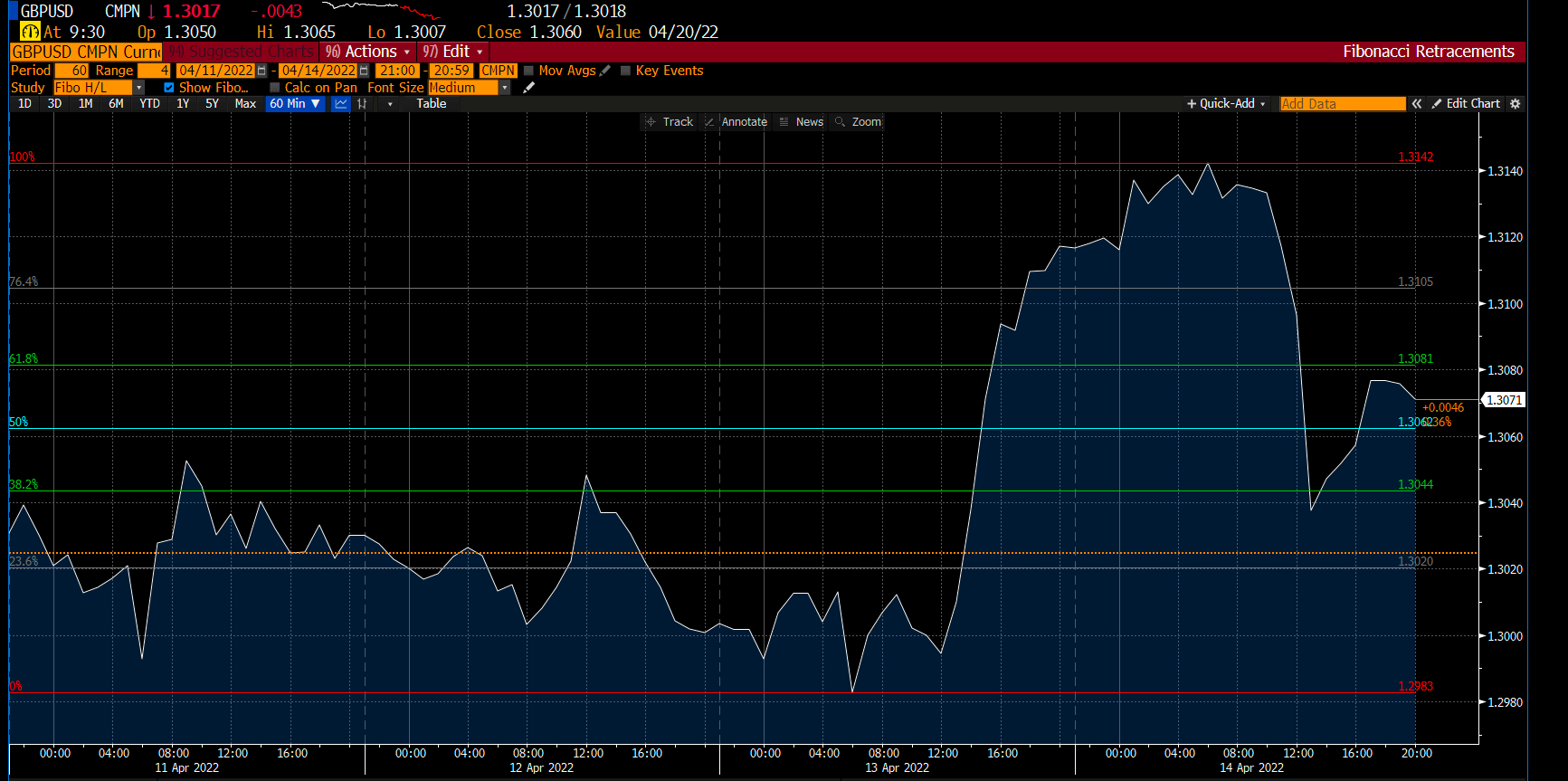

Meanwhile, GBP/USD recovered earlier in the week after falling to its lowest level since November 2020 – $1.2974. Although broad-based US dollar strength prevented GBP/USD from gaining further bullish momentum in the second half of the week, the pair ended the week above $1.3050, snapping its two-week losing streak.

As measured by the Consumer Price Index (CPI), the annual inflation in the United States jumped to a new four-decade high of 8.5% in March, comparing to 7.9% in February, according to the US Bureau of Labor Statistics. According to the report’s additional details, the Core CPI, which excludes volatile food and energy prices, increased from 6.4% to 6.5% in the same period, compared to the market expectation of 6.6%. Although the initial market reaction to the US inflation report weakened the US dollar, hawkish Fed commentary triggered a rally in US T-bond yields late on Tuesday, 12 April 2022.

Whereas in the UK, the annual CPI rose from 6.2% in February to 7% in March, exceeding analysts’ expectations of 6.7%. Despite the hot UK inflation data, GBP/USD struggled to gain traction until the US dollar came under heavy selling pressure amid falling US yields during the US trading hours on Wednesday, 13 April 2022.

GBP/USD extended its recovery to a new nine-day high of $1.3150 in the early European session on Thursday, 14 April 2022, after rising more than 100 pips on Wednesday, 13 April 2022. However, with the European Central Bank (ECB) maintaining its policy settings, the greenback regained its strength, forcing the GBP/USD to fall.

As per the hourly chart for the week seen above, GBP/USD had been moving around $1.300 (the psychological mark). However, due to heavy selling of the US dollar on Wednesday, 13 April 2022, the pair picked up and stayed alongside but could not sustain itself further. As of Thursday, 14 April 2022, the pair ended at around $1.3071 above the 50% retracement level near the $1.306 mark. If the pair continues to find its momentum, its next resistance level would be at a 61.8% retracement level, approximately at $1.3081. But if the pair spirals down, then the next support level would be at the 38.2% retracement level near $1.304.

The USD/JPY reached a high of ¥126.32 in Friday’s holiday-shortened market, capping a 0.41% (close over close) gain for the week. Inflation-boosted US Treasury yields, combined with the risks of a stalled but still dangerous Ukraine war and the Bank of Japan’s (BoJ) seemingly permanent liquidity policy, have created a near-ideal environment for the greenback against the yen.

In the coming week, there will be no high-level data releases. However, the focus will be on the Bank of England (BoE) and the Federal Reserve. The BoE has a more difficult balancing act than the US Federal Reserve in terms of policy tightening. Both central banks are battling inflation, but the BoE is growing increasingly anxious about the growth outlook in the context of a protracted Russia-Ukraine conflict.

Commodities

Source: Bloomberg. Click to see full size

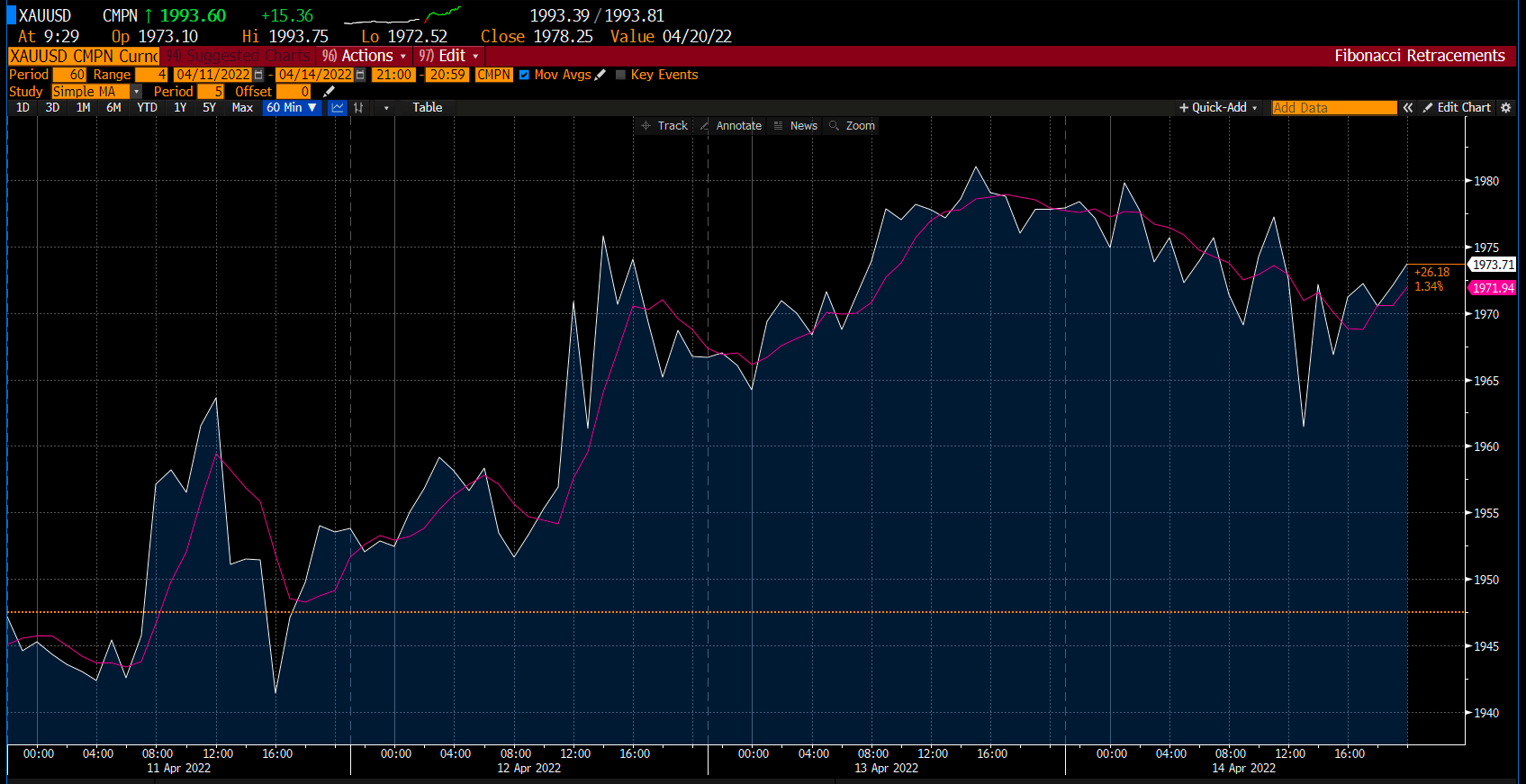

Safe-haven asset, gold saw a weekly gain. Due to the Ukraine crisis and mounting inflation, traders preferred the precious metal to park their funds on the long Easter weekend.

Gold’s prices rallied for 6 days in a row until the yellow metal eased off on Thursday, 14 April 2022. The momentum came after the US dollar strengthened and yields rose as traders geared up for US interest rate hikes. However, the bullion kept on track for its weekly gain and ended the trading week above the $1,970 level.

As per the hourly chart, gold started the week at around $1,948 and ended at around the $1,974 mark. We see an upward trend for the week, with the price ending just above the 5-day moving average at around $1,792. Even though we see a few spikes on the downside, gold maintained enough traction to post gains for the week.

Gold still maintains a strong and strengthening demand as a hedge against inflation despite the expectation that the Fed will continue to raise rates aggressively to combat detrimental price pressures through the end of 2022 and beyond.

In the oil market, prices rose by approximately 10%, with the instrument closing the week at the $106 level as traders weighed news of a possible European ban on Russian oil imports.

However, on Thursday, 14 April 2022, the trading conditions for the global oil markets were fairly thin ahead of the long weekend in the major North American and European markets due to the tightening global supply. Last week, the EU took its first steps in response to the war on Ukraine by banning Russian energy imports and agreed to stop coal imports completely, starting later this year.

Recent news from IEA members on the release of 240M barrels of crude oil reserves over the next 6 months has dampened expectations for a return to last month’s $120 levels. Additionally, if the US and Iran reach an agreement on easing sanctions, more than 1M barrels per day in Iranian supply may return to the market.

In the upcoming months, market conditions are expected to remain tight as global oil markets adjust to significant disruptions in Russian exports due to sanctions over the country’s invasion of Ukraine.

Make the most of these market opportunities by sharpening your trading strategy and trade the financial markets with options and multipliers on DTrader.

Cryptocurrencies

Source: Bloomberg. Click to see full size

Bitcoin traded on a marginal uptrend during last week, by starting the week at $39,846.47 and trading at $40,273.09 at Sunday’s close, marking a 1.07 % increase.

At the time of writing, the largest cryptocurrency in the world was trading at $40,277.39, close to its primary resistance level of $40,605.51 at the 38.2% retracement level. If it breaks through that level, its primary resistance will shift to $41,007.73 at the 50% retracement level. While Bitcoin saw some volatility during the first half of the week, it traded sideways for the latter part. However, Bitcoin has stuck to its overall decline since the beginning of April.

Altcoins such as Ethereum, Binance coin and Dash have replicated Bitcoin’s trend, having hit a peak midweek and declining ever since, to finish the week slightly higher than they started on Monday, 11 April 2022. Ethereum, Binance coin and Dash experienced nearly a 0.3%, 3.6% and 4.2% increase, respectively.

Doge experienced the ‘Musk-effect’ when Elon Musk, the newly established largest shareholder of Twitter, urged Doge as one of the payment options for Twitter Blue, resulting in an 8% increase midweek.

Cryptocurrency, in general, has been on the decline since the start of the month. However, trader sentiment is that a reversal in the trend is imminent.

Cryptocurrency has been a hot topic during the previous week and leaders of major cryptocurrency companies have expressed that regulators have started to look at digital currencies positively. For instance, the UK government announced that it would introduce stablecoins to track existing currencies’ prices. Additionally, the US President signed an executive order advocating the coordination across governments for digital assets.

In other crypto-related news, the Wikipedia community, on Tuesday, 12 April 2022, voted against all cryptocurrency donations to the platform, owing to its environmental impact. Also, in an interview with CNBC on Thursday, 14 April 2022, the Amazon CEO said that the e-commerce giant does not have plans to add cryptocurrency as a payment option soon.

US Indices

|

Name of the index |

Thursday’s close |

*Net Change |

*Net Change (%) |

|

Dow Jones Industrial (Wall Street 30) |

34,451.23 |

143.15 |

0.42% |

|

Nasdaq (US Tech 100) |

13,893.21 |

-97.00 |

-0.69% |

|

S&P 500 (US 500) |

4,392.59 |

-19.94 |

-0.45% |

Source: Bloomberg

*Net change and net change % are based on the weekly closing price change from Monday to Friday.

It was a short trading week with the markets closed for Good Friday. All the major US stock indices closed lower on Thursday, 14 April 2022, capping off a losing week as traders took in a mixed set of earnings reports and rising inflation figures.

The Dow Jones Industrial Average closed the short trading week 0.42% higher at 34,541. Meanwhile, the S&P 500 closed at 4,394, ending the week down by 0.45%. The tech-heavy Nasdaq 100 declined by 0.7% to finish around 13,893 for the week.

Stocks retreated as fresh inflation data took hold of traders’ thoughts last week. On Tuesday, 12 April 2022, the March Consumer Price Index (CPI) showed an 8.5% increase for the month.

Supplier prices have also risen above expectations. The Purchasing Price Index (PPI), which measures prices paid by wholesale suppliers, gained 11.2% from a year ago, marking its hottest yearly increase since November 2010. Meanwhile, Jobless Claims rose to 185,000 for the week ending on 9 April 2022.

As traders assessed rising inflationary pressures last week, treasury yields climbed to multi-year highs. On Thursday, 14 April 2022, the benchmark 10-year note climbed by 13-basis points to reach above 2.8%.

Both inflation fears and rising bond yields drove down technology shares late last week, as traders prioritised stable assets over high-risk growth stocks. For the week, Microsoft declined by 6.8%, Google slipped by 6.5%, and Apple tumbled by 3.7%.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv X Financial account and Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading, and the Deriv X Platform, and STP Financial Accounts are not available to clients residing in the EU or the UK.

Cryptocurrencies are not available to clients residing in the UK.