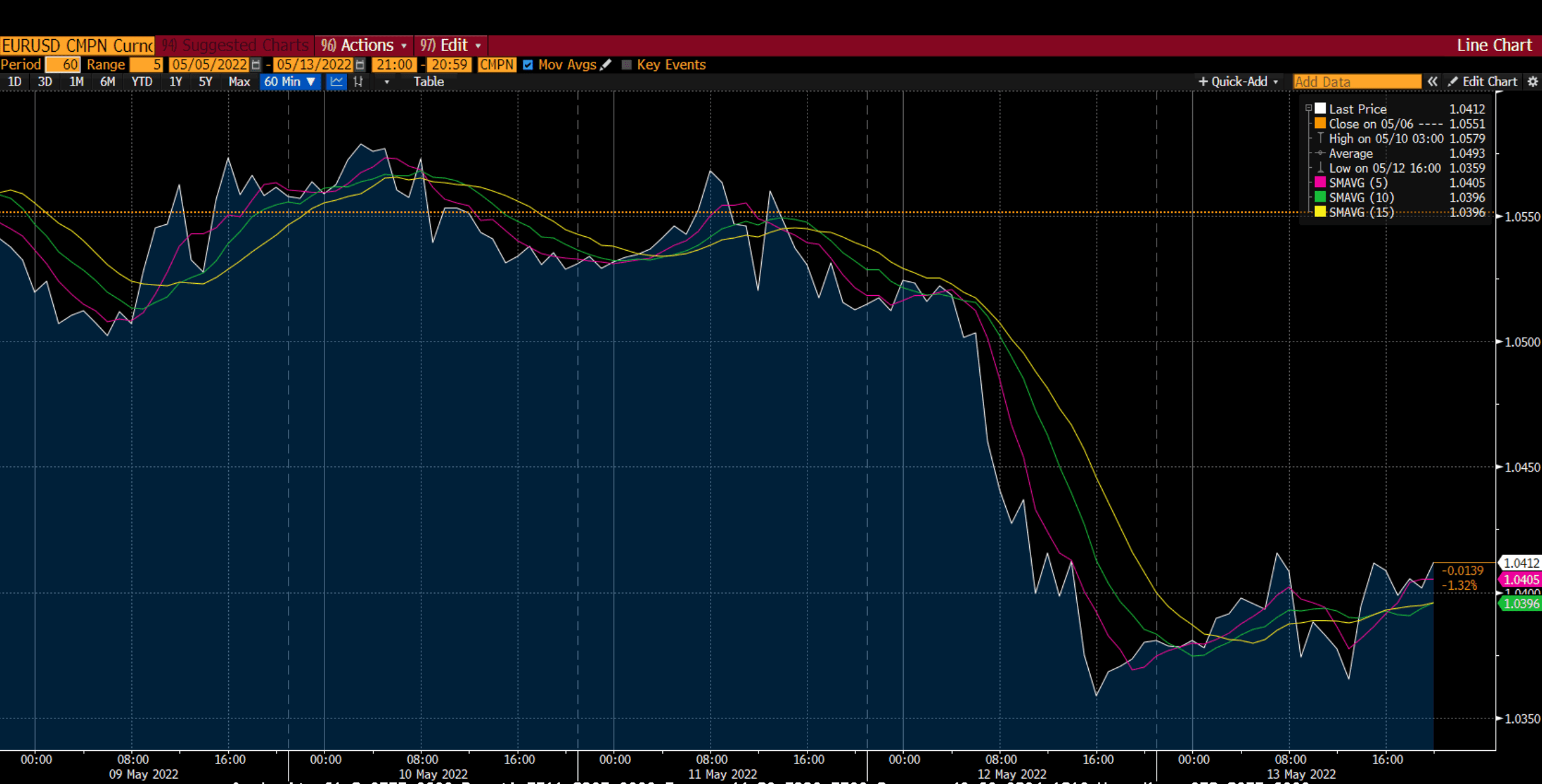

Forex

Source: Bloomberg. Click to see full size

On Friday, 13 May 2022, the US dollar index fell for the first time in 7 trading days. A recovery in equity prices weakened the greenback, which had a negative effect across the board.

The EUR/USD fell to $1.035 (the weakest it’s been in 5 years), on Thursday, 12 May 2022, amid worries of a recession and the interest rate differential between the monetary policies of the US Federal Reserve and the European Central Bank. The Euro came under severe pressure on Thursday, 12 May 2022, after several bearish geopolitical developments surrounding relations and trade with Russia regarding energy had taken place.

The chart above replicates this drop on Thursday, 12 May 2022. We can see the price fell below its support levels to act as the new resistance level. The pair picked up from the bounce but only saw a flat trend to end the week.

However, the EUR/USD pair rebounded from its lowest intraday level since 2017 and climbed back above $1.04 late on Friday, 13 May 2022. This bounce-back was due to an improvement in risk sentiment and a correction of the US dollar.

GBP/USD ended the week at approximately $1.2160, falling further by 0.3% on Friday, 13 May 2022, and taking its weekly losses to around 1.4%. In the past 4 weeks, the pair has seen losses totalling approximately 7.0%. In particular, the pound ended the day at its lowest since November 2020, when the UK was in a coronavirus lockdown.

GBP/USD was under heavy pressure last week caused by the strong safe-haven asset US dollar and because of a combination of bearish factors arising from the UK and Europe. Data showed that inflation has slowed, and underlying price pressures remain elevated, weighing on traders’ sentiment.

The USD/JPY is gradually moving higher and is expected to reclaim the mark of ¥130.00 as traders brace themselves for a hawkish tone from Federal Reserve’s chair Jerome Powell on the coming Tuesday, 17 May 2022. The speech from Fed Chair Powell will shed some light on the Fed’s monetary policy stance in its June interest rate announcement.

Meanwhile, the Japanese Yen is facing pressure after the Bank of Japan’s (BoJ) Governor, Harihuko Kuroda, promised a conservative monetary policy in the future. This statement was published on Friday, 13 May 2022, highlighting that the economy has not yet achieved its pre-pandemic growth levels, and inflation is still not at par with the targeted levels.

The economic calendar for next week is fairly light as US retail sales and EU inflation data are likely to steal the spotlight.

Level up your trading strategy with the latest market news and trade CFDs on your Deriv X Financial account.

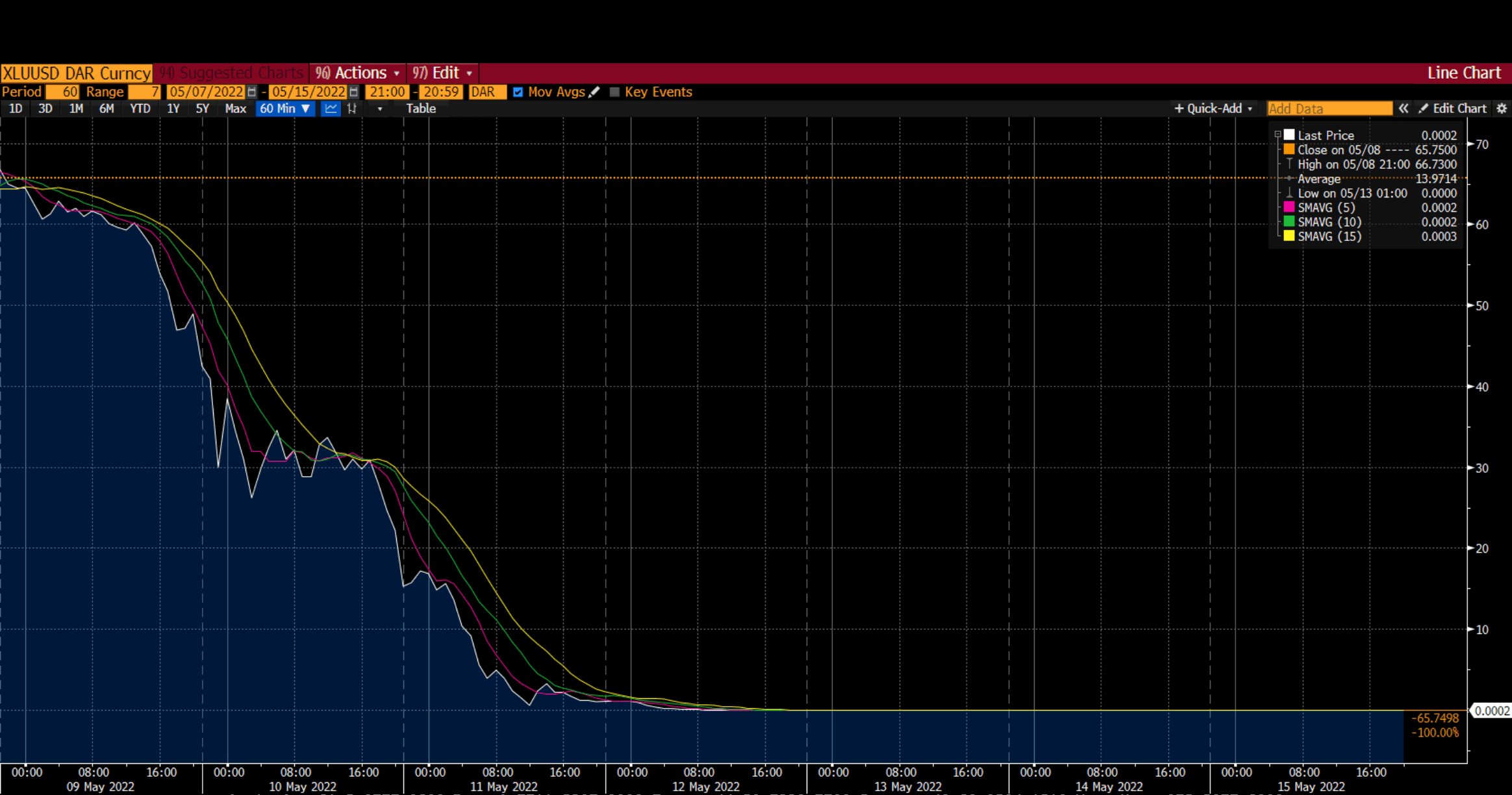

Cryptocurrencies

Source: Bloomberg. Click to see full size

Last week, the global market capitalisation of cryptocurrencies stumbled below $1.2 trillion, falling by about 65% from its peak of $3.2 trillion at the end of 2021. The global crypto market capitalisation saw a decline of nearly 27% in the market volume on Thursday alone.

The world’s most popular cryptocurrency fell by more than 10% in a single day. On Thursday, 12 May 2022, the price of Bitcoin dropped to around $26,000, its lowest level since December 2020. It steadied at about $30,000 on Friday, 13 May 2022, but that was still less than half of Bitcoin’s price last November – $69,000. However, the weekly net change in Bitcoin volatility was the highest in the two years.

The recent decline in stablecoins has made crypto markets vulnerable. As per a Bloomberg report, the wipeout of algorithmic stablecoin Terra/USD and its sister token Luna knocked more than $270 billion off the crypto sector’s total trillion-dollar value.

Stablecoins have been viewed as a safe harbour among cryptocurrencies because the value of many stablecoins is pegged to a government-backed currency, such as the US dollar, or precious metals such as gold.

But this week, Terra experienced the unexpected. Terra’s problems began with withdrawals from Anchor, a platform that supported this stablecoin. Since Friday, 13 May 2022, Anchor’s total deposits have fallen from $14 billion to $2.2 billion. Along with concerns about cryptocurrencies as a whole, and the drop in Bitcoin’s price, Terra started to lose its peg to the US dollar.

After beginning the week on Monday at $66, the coin Luna was trading at approximately $0.0002 on Friday, 13 May 2022.

Furthermore, Polkadot dipped by over 3% in market cap and over 26% in volumes. Solana dropped by over 2% in market cap and 25.5% in volumes, while Avalanche slipped by over 3% in market cap and fell by nearly 32% in volumes.

Maximise market opportunities by sharpening your trading strategy and trading the financial markets with options and multipliers on DTrader.

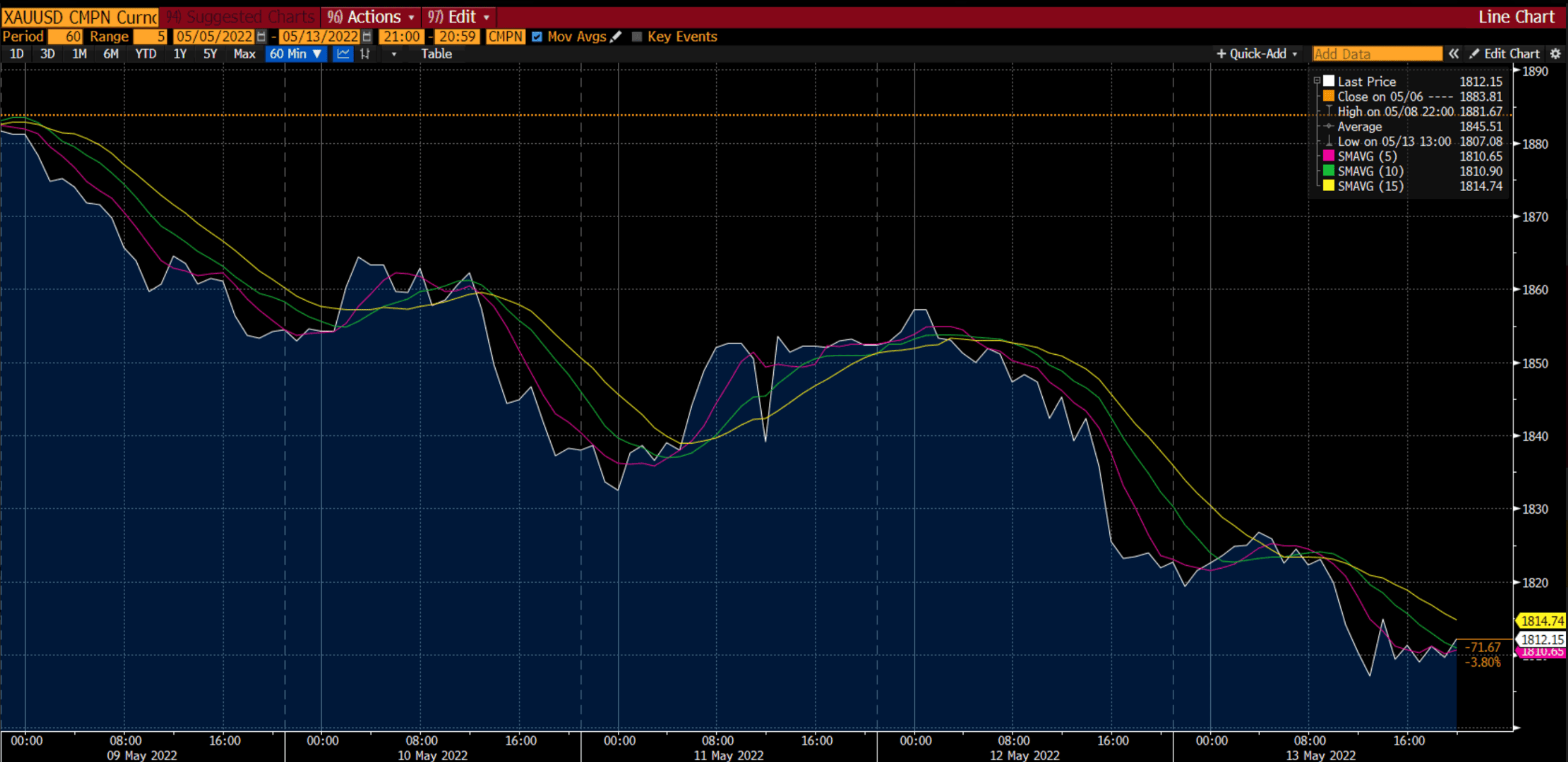

Commodities

Source: Bloomberg. Click to see full size

Despite recovering from Friday’s fall below $1,800, gold lost more than 2% on a weekly basis as the Dollar Index extended its winning streak to 6 weeks when the Federal Reserve increased interest rate expectations. According to Jerome Powell, the FOMC is expecting 2 more 50 basis point rate hikes in June and July, which indicates they will do more if data “turns the wrong way.” As a result, the US Dollar Index hit a nearly two-decade high of around $105.

From a technical perspective, gold prices continued to decline and have attempted to go below the $1,800 mark, extending the bearish trend. On Friday, 13 May 2022, gold traded sideways near its two-month low of $1,810. Although gold briefly fell below $1,800 in the American session, it managed to recoup some of its daily losses and ended the week at around $1,812.15. This recovery came after the University of Michigan’s monthly publication revealed that consumer confidence in the United States fell in early May.

Based on the hourly chart for the week, if gold continues to decline, its support level would be near $1,807.07. Additionally, due to the recoup, it managed to stay slightly above the SMA 5 and SMA 10 at $1,810.65 and $1,810.90, respectively.

Traders are also concerned that a more aggressive move by major central banks to contain inflation could harm global economic growth and precipitate a recession. Furthermore, shockingly poor Chinese macro data exacerbated the fears and, when combined with the resurgence of geopolitical tensions, weighed on risk sentiment, forcing traders to seek refuge in traditional safe-haven assets. This shift may provide some support for the safe-haven metal. Aside from that, the yellow metal’s attractiveness as an inflation hedge may help limit further losses for the XAU/USD, at least for the time being.

On the other hand, the oil market has been volatile this week, falling below $100 amid concerns about the US and global economic slowdown, which could reduce demand for crude. However, oil seemed to have recovered most of those losses recently, as sharply falling US inventories of refined fuels combined with ongoing tensions between Russia and Ukraine shifts the market’s focus back to the supply side.

This week, market participants will be looking for clues about the possibility of a 75-bps rate hike from remarks by several FOMC officials, including Fed Chair Jerome Powell. This economic event, in turn, will have a significant impact on the near-term USD price dynamics and provide a new directional boost to gold.

In addition to this, Foreign ministers from the EU will meet in Brussels to discuss the next round of Russian sanctions, and diplomats have floated the idea of delaying a proposed ban on its oil imports in response to Hungary’s objections. According to government officials, Germany intends to stop importing Russian crude by the end of the year if the EU fails to agree on coordinated action.

US Indices

|

Name of the index |

Friday’s close |

*Net Change |

*Net Change (%) |

|

Dow Jones Industrial (Wall Street 30) |

32,196.66 |

-49.04 |

-0.15% |

|

Nasdaq (US Tech 100) |

12,387.40 |

199.68 |

1.64% |

|

S&P 500 (US 500) |

4,023.89 |

32.65 |

0.82% |

Source: Bloomberg

*Net change and net change % are based on the weekly closing price change from Monday to Friday.

US Indices had a mixed week as traders grew increasingly doubtful that the Federal Reserve could prevent a recession by raising interest rates enough.

With the Fed’s policy change, the consumer price index (CPI) was expected to show a slowing in inflation, giving traders relief. CPI rose by 8.3% in April compared to 8.5% in March, while core prices (excluding food and energy) rose by 6.2% versus 6.5%. The 0.6% monthly gain in the core index was of particular interest, with it being the largest gain in 3 months. Moreover, rates for rentals and airline fares rose by 0.6% and 18.6%, respectively, as travel demand rebounded strongly.

Also, the US government bond prices recovered modestly on Friday, 13 May 2022, with the 10-year US Treasury bond yield falling to around 2.93%. The 10-year yield had risen to 3.13% in the previous week after breaking through the 3% barrier for the first time since November 2018. It may be that the inverse correlation between stocks and treasuries is returning as stocks fell significantly this week, explaining the fall in yields as a whole and the increase in the Treasury prices.

Currently, the main drivers of the market are the Fed’s accelerated pace of monetary tightening, persistently high inflation data, concerns about slowing growth, and disruptions caused by China’s strict COVID-19 lockdowns.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv MT5 Financial and Financial STP accounts.

Disclaimer:

Options trading, Deriv X Platform, and STP Financial Accounts on the MT5 platform are not available for clients residing in the EU.

Terra (UST/USD) and Luna (TER/USD) are not available for trading on our platforms.

This content is not intended for clients residing in the UK.