After a three-week losing streak, many markets saw gains last week as traders focused on Federal Reserve rate hikes, inflation, and the implications for the economy in the coming months.

Forex

Source: Bloomberg. Click to see full size.

As the weekend approached, EUR/USD traded at $1.0047, up from $0.9932 at the start of the week.

This rise can be attributed to European and American authorities prioritising inflation control over growth stimulation. As expected, the European Central Bank (ECB) raised rates by 75 basis points. Additionally, the ECB pledged to keep raising rates as long as inflation remains high. Meanwhile, Fed Chairman Jerome Powell delivered an aggressive statement stating that the Central Bank must act strongly until inflation is reduced to 2%.

Following these events, German Bund rates reached their highest level in almost a decade. Rates on US Treasury bonds rose too, but they stayed below their weekly highs, preventing the US dollar’s price from rising.

Meanwhile, GBP/USD ended a three-week losing skid and staged a remarkable recovery from four-decade lows of $1.1405. The markets’ expectation that Britain’s new Prime Minister, Liz Truss, will unveil a new economic package to address the energy crisis contributed to the pound’s recovery from multi-decade lows.

This week, in addition to the Gross Domestic Product figures for the UK, the focus would be on the inflation metrics for the euro, British pound, and US dollar.

Level up your trading strategy with the latest market news and trade CFDs on your Deriv X Financial account.

Commodities

Source: Bloomberg. Click to see full size

Gold began the week at $1,713.52 and had been trading in an Ascending Triangle pattern with an upward-sloping trendline drawn from Wednesday’s low of $1,694.31.

With the US dollar under intense selling pressure on the first half of Friday 9 September 2022, gold extended its upward correction, reaching a ten-day high of approximately $1,730. However, the yellow metal failed to maintain its positive momentum. It barely changed below $1,720 in response to expectations that the Federal Reserve would continue raising interest rates and ended the week without a convincing move in either direction.

Meanwhile, WTI finished the week virtually unchanged in the last 7 days – closing at around $86 per barrel. At the start of the week, WTI and Brent fell to lows not seen since the beginning of the year.

This week, the spotlight will be on the release of inflation numbers in the US, which might cause a strong reaction. A drop in inflation expectations should hit the US dollar, whilst an unexpected rise might help the currency to gain strength and weigh on XAU/USD.

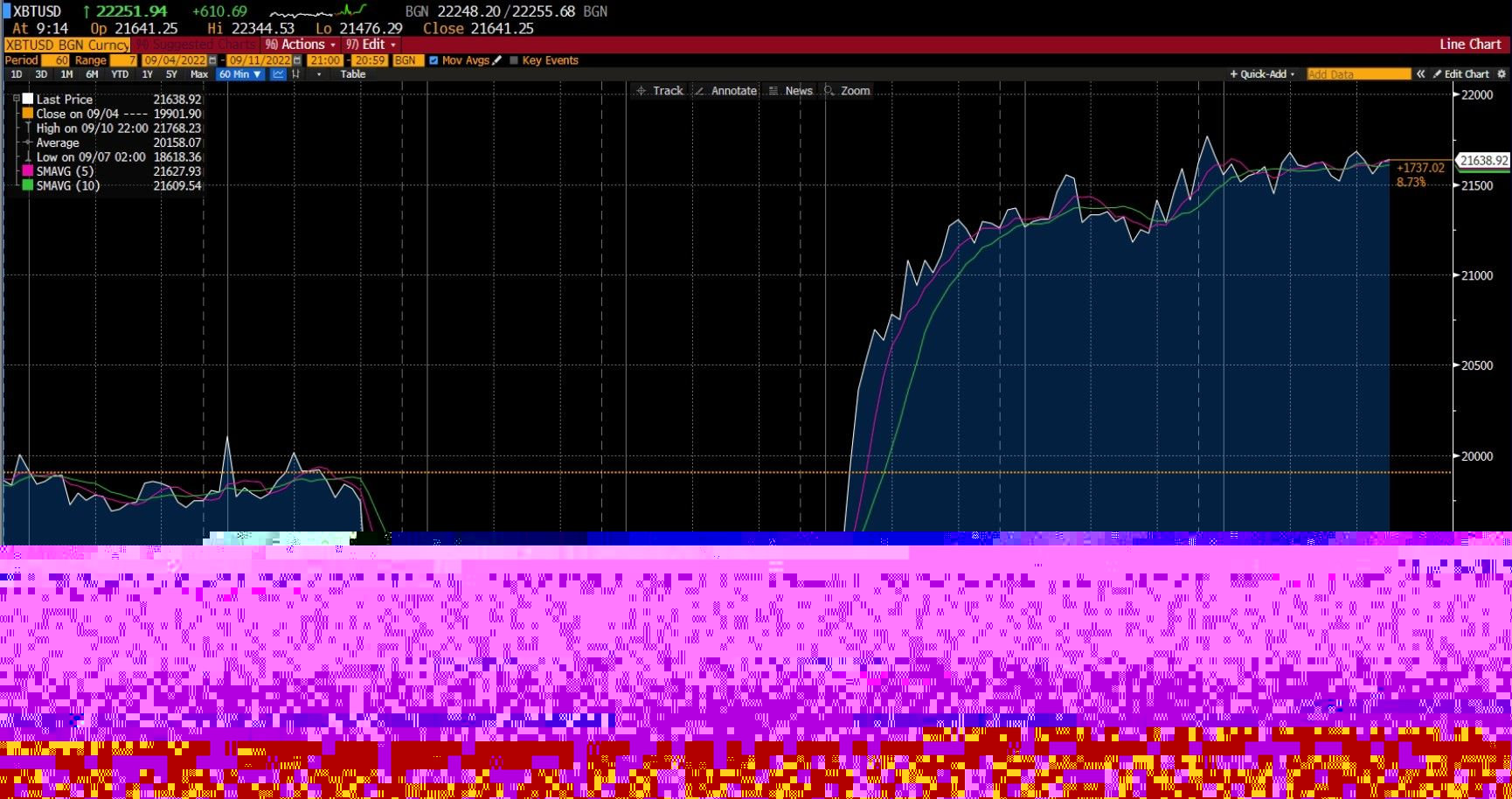

Cryptocurrencies

Source: Bloomberg. Click to see full size.

Cryptocurrencies experienced a volatile week. The global crypto market capitalisation fell below $1 trillion on Wednesday, 7 September 2022. Bitcoin was at the epicentre of market volatility, with its prices fluctuating between $18,000 and $21,000.

Bitcoin dropped by over 6% during the first half of the week. By mid-week, the most popular digital token was trading slightly below the $18,750 level and was close to testing the 2022 lows.

However, there was a big change in trend on Friday, 9 September 2022, when the largest cryptocurrency by market value rallied more than 10% to reach the $21,000 level, as seen in the chart. This was Bitcoin’s most significant daily gain in 6 months.

At the end of the week, Bitcoin was trading at $21,638.92. The global cryptocurrency market capitalisation climbed back to cross the $1 trillion threshold, touching $1.06 trillion. In addition, the total crypto trading volume slightly increased to $72.92 billion.

Other cryptocurrencies, namely Ethereum, Litecoin, and Dogecoin, saw gains of 9%, 4%, and 2%, respectively, during the week.

The Ethereum merge is expected to take place this week and is likely to impact trading decisions.

Take advantage of market opportunities by sharpening your trading strategy and trading the financial markets with options and multipliers on DTrader.

US stock markets

|

Name of the index |

Friday’s close |

*Net change |

*Net change (%) |

|

Dow Jones Industrial Avg (Wall Street 30) |

32,151.71 |

833.27 |

2.66% |

|

Nasdaq (US Tech 100) |

12,588.29 |

489.85 |

4.05% |

|

S&P 500 (US 500) |

4,067.36 |

143.10 |

3.65% |

Source: Bloomberg

*Net change and net change (%) are based on the weekly closing price change from Friday to Friday.

The major averages ended a three-week losing streak on Friday, 9 September 2022, after rallying for three straight days. In the past week, the Dow gained by 2.66%, the S&P 500 rose by 3.65%, and the Nasdaq increased by 4.05%.

Stocks rallied after the Wednesday afternoon release of the Fed’s “Beige Book”, which summarises economic reports from its branch banks. The report indicated moderate price increases in 9 of its 12 districts. The report also highlighted some declines in the prices of steel, lumber, and copper.

Traders have become more confident that the market has reached a temporary bottom after it surrendered about half its summer rally.

Plus, the markets showed resilience to come out on top, despite Wall Street anticipating a 0.75 percentage point rate hike after Fed Chair Jerome Powell reaffirmed his commitment to bring inflation down.

We can expect an eventful week of economic reports, with the Consumer Price Index (CPI) providing the latest update on consumer inflation on Tuesday, 13 September 2022. The Producer Price Index (PPI) will follow on Wednesday, 14 September 2022.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv MT5.

Disclaimer:

Options trading and the Deriv X platform are not available for clients residing in the EU.