After the release of core CPI numbers, all eyes will be on the ECB meeting next when they make their pronouncement on the Eurozone’s interest rate, which currently stands at a record 4.5% after 10 consecutive rate hikes. These moves saw the inflation rate go from 8.5 this time last year, before easing down to the current 2.9%.

ECB monetary policy rate

The year 2023 saw the region slump into what many analysts called a “quasi-recession” as the two largest economies, Germany and France, took major hits. These were precipitated by tough ECB monetary restrictions. The ECB’s tightening was considered harsh but necessary, to tame inflation levels that had risen to 10.6% in October 2022. This led to a squeeze in consumer spending which was felt across sectors such as construction and real estate.

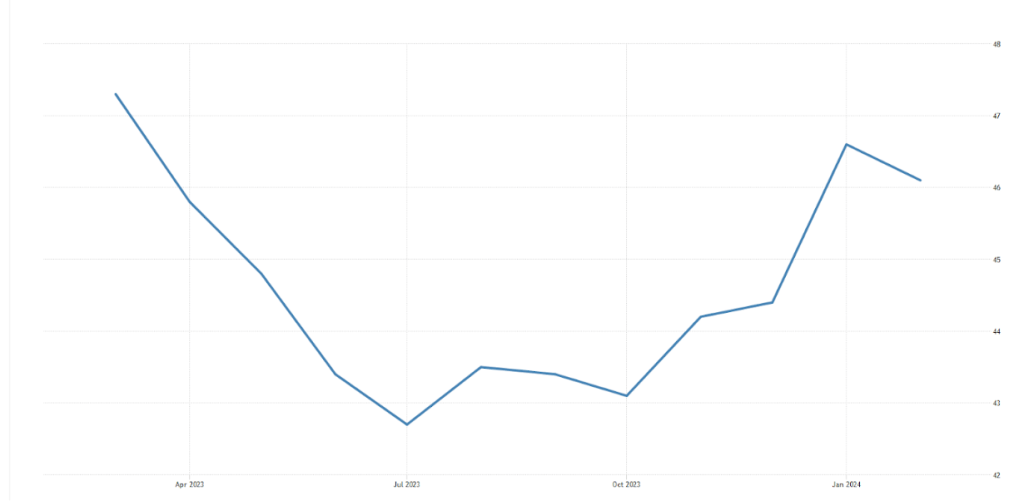

Exports also took a hit as a hike in prices meant less orders, which translated to reduced manufacturing activity in major EU economies like Germany. This has led to successive negative PMI (Purchasing Managers Index) numbers in the Eurozone, with January’s composite number coming in at 47.9. With numbers well below the 50 mark (a benchmark for growth and increased commercial activity), prospects of a recession heightened.

Eurozone PMI chart

Source: Trading economics

ECB interest rate projections

With Eurozone economies ailing thanks to shocks precipitated by tight monetary policy, analysts have been speculating about a possible ECB rate cut.

Portugal’s Central Bank Chief, who is also a member of the ECB governing council, had this to say, “March is the date when we have the largest amount of data in front of us- some data may tell us to discuss interest rate cuts as soon as March. I’m not saying that it is likely, but we have to be open.”

He expressed positivity that the inflation rate will be within the ECB target soon, which some analysts see as a positive sign ahead of the council meeting, “Inflation has been consistently below our forecasts in recent months – and growth as well. This is a sign that the downside risks that we identified in the last two forecasts have materialised.”

These statements have left analysts wondering how many members on the council will be in favour of an early March rate cut, as opposed to a delayed approach that could see a cut coming later this year.

According to a recent Reuters poll, nearly two-thirds of economists predict that the ECB will initiate its first interest rate cut in June. President Lagarde recently emphasised the significance of Q1 wage data, due in May, making June the favoured month for a rate cut among both markets and economists. Among 73 forecasters, 46 anticipate a 25 basis points reduction in June, reflecting a substantial increase from previous estimates. Only 17 economists foresaw a rate cut in April, while 10 suggested that the ECB might defer the decision until the second half of the year. None of the economists surveyed anticipated a rate cut at the March 7 meeting.

EUR/USD price movement

Source: Deriv

At the time of writing, the 50-day simple moving average (SMA) is crossing below the 200-day SMA, signalling a potential beginning of a downtrend. However, the relatively flat nature of these lines, coupled with an RSI of around 45, suggests some market indecision. Traders should closely monitor the decisions of the ECB governing council as they could significantly impact the EUR/USD pair. A surprise rate cut could offer traders opportunities to capitalize on increased volatility.

Keep an eye on the news, and make your EUR/USD speculations with your Deriv account. If you don’t have one yet, sign up for a free demo account, which comes with virtual funds so you can practise your strategies risk-free.

Disclaimer:

Trading is risky. Past performance is not indicative of future results. It is recommended to do your own research prior to making any trading decisions.

The information contained in this blog article is for educational purposes only and is not intended as financial or investment advice.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

You may also like: