Forex pairs are a combination of two different currencies. When traded, investors are essentially participating in a dual transaction – purchasing one currency while simultaneously selling another.

In this guide, we’ll cover:

How to read forex quotes

Currency pairs consist of two parts: the base (first) currency and the quote (second) currency. The exchange rate for a currency pair specifies how much of the quote currency is needed to buy one unit of the base currency.

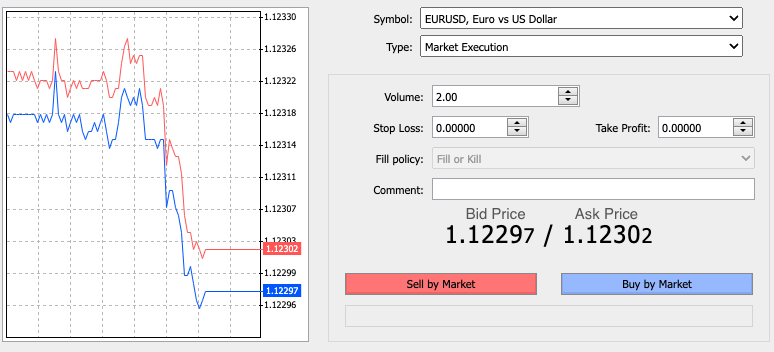

So, if the exchange rate of the EUR/USD pair is 1.12302, this means that you will need the amount of 1.12302 USD to buy 1 EUR.

As shown in the Deriv MT5 platform example below, CFD brokers typically quote currency pairs with two prices: the bid price (for selling) and the ask price (for buying). The difference between these prices is called the spread, which, in essence, represents the transaction cost when entering or exiting a trade.

Classification of currency pairs

Forex pairs are categorised based on their trading volumes and the economic strength of the currencies involved.

Major currency pairs consist of the most frequently traded currencies in the world. Majors tend to have tighter forex spreads and higher liquidity due to their widespread popularity. Below lists the major pairs available for CFD trading at Deriv.

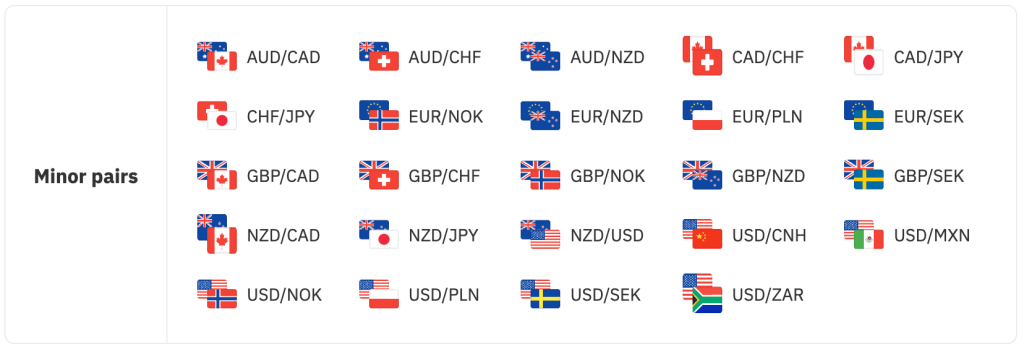

Minor currency pairs, also known as ‘crosses,’ include major currencies in the base or quote currency, often excluding the US dollar. Minors usually have slightly wider spreads and lower liquidity compared to major pairs. Below are the minor pairs available for CFD trading at Deriv.

Exotic currency pairs consist of a major currency paired with a currency of an emerging or smaller economy. Exotic pairs are less liquid and often have wider spreads than both majors and minors. Below are the exotic pairs available for CFD trading at Deriv.

Understanding the basics of currency pairs provides a crucial foundation for effective forex trading. By recognising the differences in liquidity and forex spreads between major, minor, and exotic currency pairs, traders can make better informed decisions and increase their chances of successful trades.

Get a practical understanding of the spreads between the different types of currency pairs by trading them risk-free. You can do so with a demo account that’s credited with virtual funds.

Disclaimer:

The information contained in this blog article is for educational purposes only and is not intended as financial or investment advice.

Deriv MT5’s availability might depend on your country of residency.

Exotic pairs are unavailable to clients residing within the European Union.