There are many moving parts in online trading. First, you need to learn how to trade. Second, you’ll need a trading strategy. Third, you’ll need to test out that strategy. Finally, you must keep track of your trades so you can maximise your profits when you win or limit your losses when your predictions go against you.

This process may appear easy, but if you have been trading for some time, you’d know that it involves a lot of repetitive tasks and there’s actually a lot of technical and fundamental analysis to do. The good news is, with automated trading, you can automate your trades so that you won’t have to stare at your screen all day.

Thanks to modern technology, auto trading bots are easy to create and only require minimal effort to deploy. Plus, you don’t have to worry about hiring a programmer to build a trading robot for you, and there’s no need to learn how to code.

In this blog, we’ll walk you through what automated trading is, how trading robots work, and why you should use one for trading.

What is automated trading?

Automated trading is a financial trading method where you set and execute your trading decisions with the help of a trading robot.

The automated trading system (ATS) is a subset of algorithmic trading. It uses a computer program to generate trade orders and automatically executes them.

The trade orders are dependent on your technical analysis and the parameters you’ve set.

How do trading robots work?

In automated trading, a trading robot interacts with the online trading platform via an application program interface (API). This API acts as the middleman which takes your requests, tells the trading robot what you want it to do, and delivers back the responses to you.

Once you enable your trading robot, it will automatically enter, monitor, and exit trades based on the rules you have set. The good thing about some trading robots is that you don’t need to learn how to code. One great example is Deriv’s DBot.

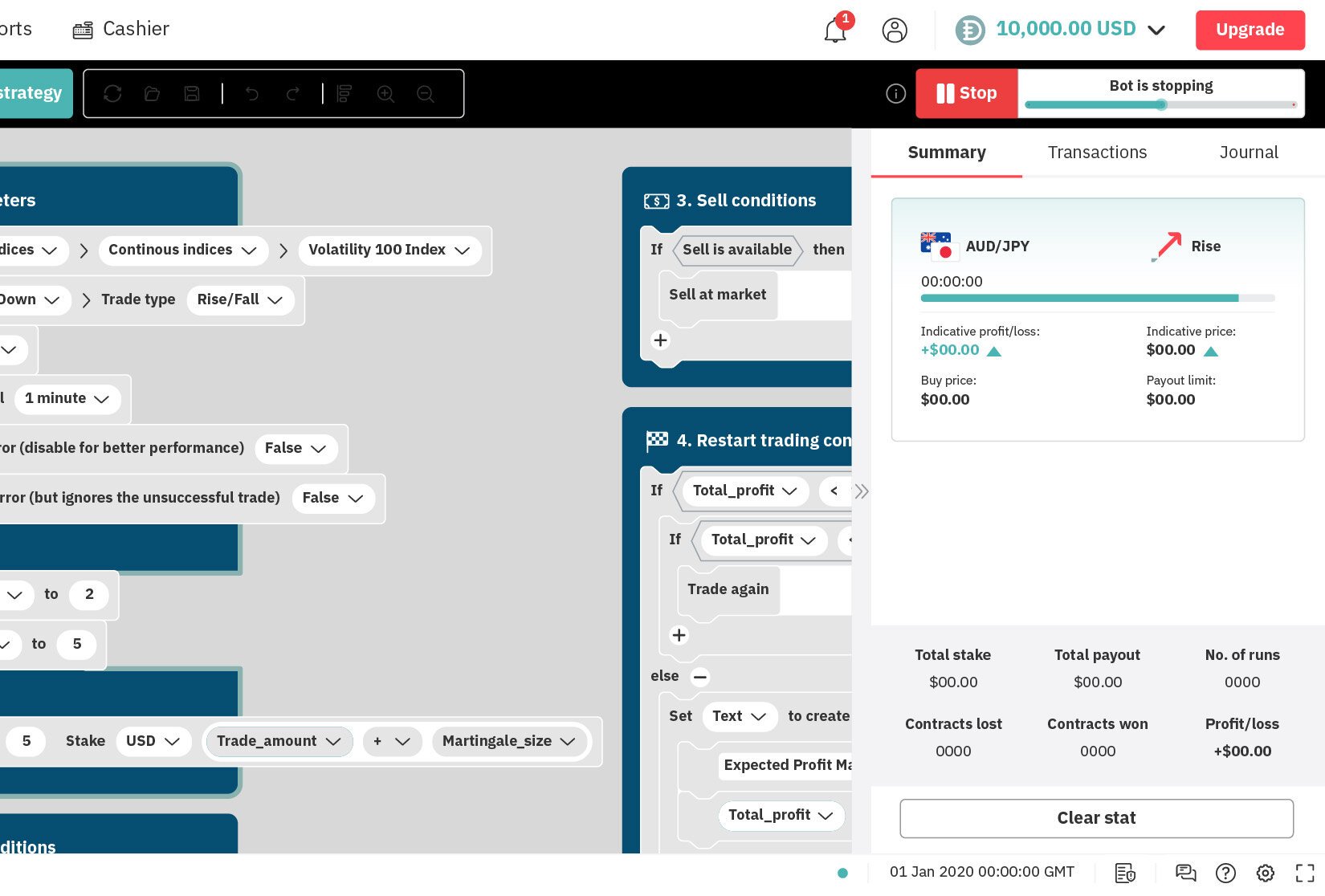

The DBot trading platform has a drag-and-drop robot builder that is customisable. All you need to do is select the blocks and indicators to match your trading strategy. You can use simple formulas to get yourself started, but you can also create sophisticated algorithms. The trading robot you build then does all the trading for you, so you do not have to stay glued to your computer all the time.

Why use trading robots

Your bot, your rules

Trading bots eliminate the need for constant market monitoring. It will keep track of the markets on your behalf all day long, so you can take advantage of every trading opportunity. This means that you won’t have to be tethered physically to your trade terminal. With a trading robot, you just have to set the rules, and it executes them, enabling you to manage your trades more efficiently.

Emotionless trading

Trading involves money, and emotions come along with it. A lot of traders are influenced by fear and greed when making trading decisions. Fear of loss can make traders hesitate before taking a trading position, leading to lost opportunities. Likewise, too much greed for greater profits may force a trader to hold on to a position for too long or make reckless decisions, which may also cause financial losses.

A trading robot enables trading without emotions. It will not think twice about making decisions since it works based on your preset commands.

Round-the-clock trading

Trading robots don’t sleep, which means you can trade at any time and from anywhere. It does not require constant monitoring, so you can catch market movements even while you’re away. It’s just a matter of setting your desired specifications and letting the trading robot do the work.

Disciplined trading

Discipline and patience are two essential attributes that distinguish great traders from the rest. They are constantly refining their strategies and making decisions based on the data they collect.

With a trading robot, you can examine your trade history and apply what you’ve learned to future trades. Most trading robots like DBot let you practise in a trial environment to learn the ropes and develop a trading strategy that suits you. The more you practise, the more discipline you are likely to develop in your trading.

Want to try trading with a trading robot? Sign up for a free Deriv demo account to practise with DBot.