Oil prices endured a grim week — sliding a remarkable 13% — as turmoil gripped the Western banking system.

Forex

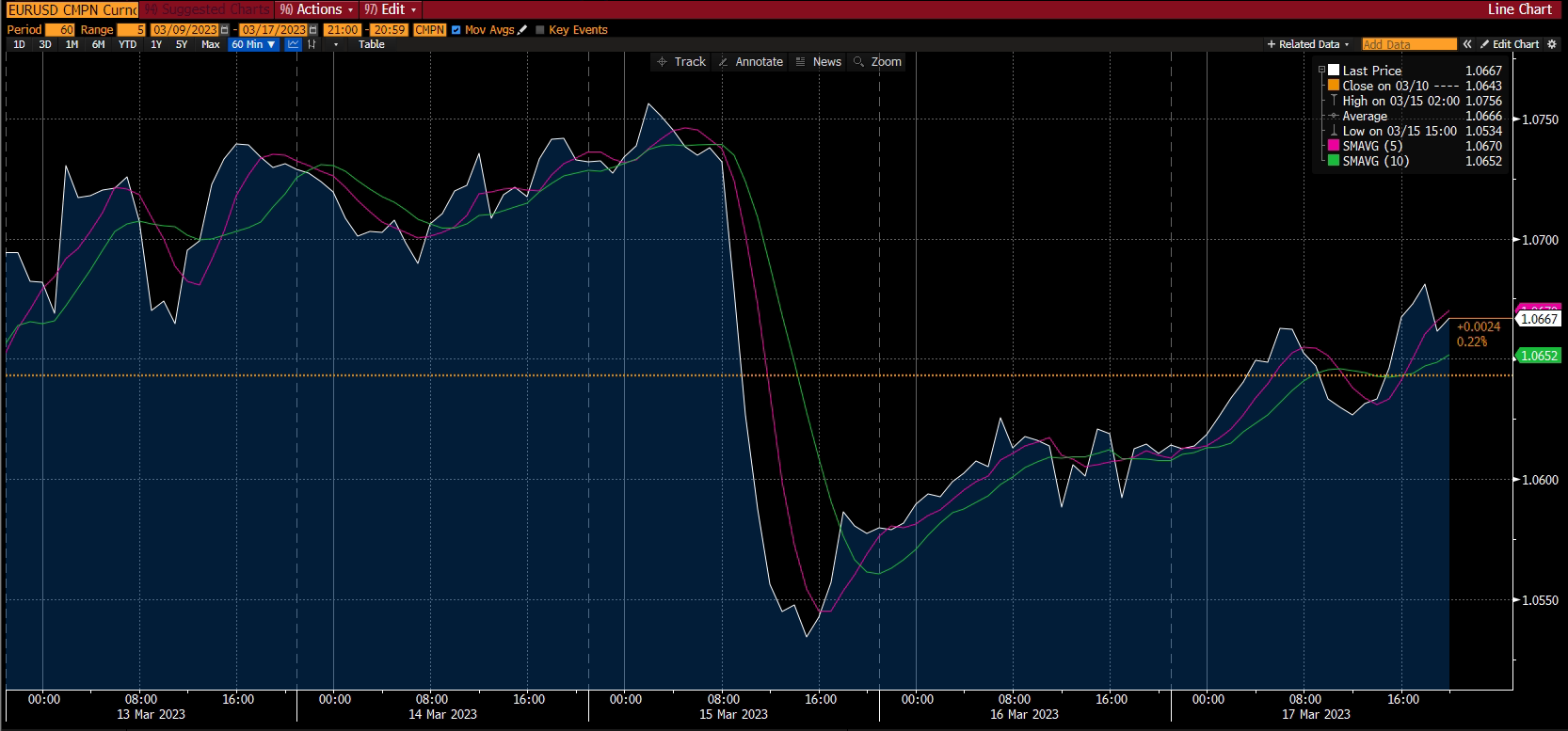

Source: Bloomberg

The EUR/USD pair slid heavily on Wednesday, 15 March, before gaining some ground and closing the week at 1.0667 USD. The banking crisis across the US and Europe — with the collapse of Silicon Valley Bank and Signature Bank in the US, and ongoing troubles at Credit Suisse in Switzerland — cast a shadow over the financial markets throughout the week.

The European Central Bank announced a 50 basis point hike on Thursday, 16 March, which led to a fall in yield in the US and German yields. The US Federal Reserve (Fed) will announce its own policy rate decision later this week.

Meanwhile, the GBP/USD pair closed the week at 1.2179 USD to mark significant gains, having closed the week prior at 1.2033 USD. The USD/JPY pair dropped below the 132 USD mark after the slide in US treasury bond yields on Friday, 18 March.

On the events front, all eyes will be on the US Federal Reserve’s interest rate decision which will be announced on Wednesday, March 22. Although a 25 basis point is the most likely outcome of the Federal Open Market Committee (FOMC) meeting, the ongoing banking turmoil has some observers suggesting that the Fed may keep rates unchanged. Also, Initial Jobless Claims data as well as the New Home Sales numbers will be released a day later on Thursday, 23 March.

Level up your trading strategy with the latest market news and trade CFDs on your Deriv X account.

Commodities

Source: Bloomberg

Gold prices registered major gains, rising more than 100 USD during the week as they approached the 2,000 USD mark. The prices of the yellow metal reached an 11-month high of 1,988.33 USD on Friday, 17 March. Gold prices are benefiting from risk aversion and the reversal in bond yields.

The February inflation data, which showed a decline, has raised hopes of a cautious approach from the US Federal Reserve, especially with the crisis in the banking sector. Its decision on policy rate hikes will have a significant impact on the price of the precious metal in the near term.

Meanwhile, oil prices endured a torrid week as they slumped to their lowest level in 15 months. Their prices collapsed a remarkable 13% for the week in the wake of the instability in the banking sector which has raised fears of an impending recession. A slowdown in economic growth will negatively impact the prices of the commodity.

Oil prices are expected to remain under downward pressure until the banking crisis gripping the West remains unresolved. Meanwhile, crude oil inventories — which measure the weekly change in the quantity of crude oil held by firms in the US — will be announced on Wednesday, 22 March.

Cryptocurrencies

Source: Bloomberg

The global cryptocurrency market continued to display a bullish sentiment and reached a cumulative worth of 1.18 trillion USD on Sunday, 19 March. The ongoing financial crisis in the United States, particularly the upheaval in the banking industry, has prompted investors to turn to cryptocurrency as an alternative, boosting prices.

The current banking sector crisis, the impact of inflation in the US, and renewed hopes for a dovish Federal Reserve has Bitcoin reaching levels not seen since June last year. At the time of writing, the leading cryptocurrency was trading at 27,985 USD, marking a 16% boost in its value over the past 7 days. Similarly, Ethereum, the second-largest digital currency by market capitalisation, also drew strong interest, with its value increasing a remarkable 24.75% over the week to reach 1,783.82 USD.

In a significant development towards the mainstreaming of cryptocurrencies, one of Australia’s largest banks, National Australia Bank (NAB), has broken the blockchain barrier by becoming the first major financial institution to complete an intra-bank cross-border transaction on the Ethereum blockchain using its own NAB-issued stablecoin.

Take advantage of market opportunities by sharpening your trading strategy and trading the financial markets with options and multipliers on DTrader.

US stocks

| Name of the index | Friday’s close | *Net change | *Net change (%) |

| Dow Jones Industrial Avg (Wall Street 30) | 31,861.98 | – 47.66 | -0.15 |

| Nasdaq (US Tech 100) | 12,519.88 | 689.60 | 5.83 |

| S&P 500 (US 500) | 3,916.64 | 55.05 | 1.43 |

*Net change and net change (%) are based on the weekly closing price change from Friday to Friday.

US stocks bounced back from their recent slump which followed the collapse of Silicon Valley Bank and Signature Bank. Nasdaq was the biggest gainer with a 5.83% rise over the course of the week, while S&P was up 1.43%. Meanwhile, Dow Jones was down a meagre 0.15%. The gains, in what has been a grim week for the financial markets, was driven by a historic plunge in bond yields.

Some US government bond yields registered their biggest drop in decades as investors hope that the US Fed will halt its recent pace of policy rate hikes in a bid to prevent a potential fallout in the wake of collapse of regional banks. The bankruptcy of the two banks and issues at Swiss lender, Credit Suisse, have raised fears of a contagion that could herald a 2008-like recession which followed the collapse of Lehman Brothers.

The US Fed is now fighting the twin problem of keeping the inflation in check while maintaining financial market stability. The course of the Fed’s direction will become clear in their Wednesday, March 22, meeting — analysts predict a 25 basis point hike in the near-term and rate cuts later in the year.

Meanwhile, in a bid to stem the problems at Credit Suisse, the Swiss authorities have persuaded UBS Group to buy its rival in a landmark deal that carries a 3.23 billion USD price tag for UBS, which will also assume the 5.4 billion USD of Credit Suisse’s losses. The deal is expected to be completed by the end of 2023. Following the announcement of the deal on Sunday, 19 March, the US Federal Reserve, European Central Bank, and other major central banks issued statements to reassure markets.

Now that you’re up-to-date on how the financial markets performed last week, you can improve your strategy and trade CFDs on Deriv MT5.

Disclaimer:

Options trading and the Deriv X platform are unavailable for clients residing in the EU.